• The compression of yields, inflation expectations, and volatility in Q2 was “the best of all possible worlds” for risk assets, but we suspect it is on borrowed time. Our near-term outlook has turned more cautious for risk as odds build that the next 10% move is lower, not higher.

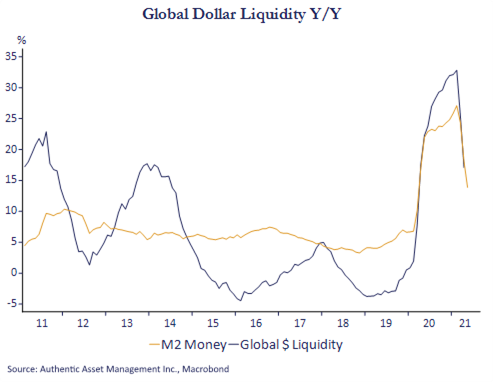

• The premium investors pay per unit of profit growth is topping out and is poised to decline as the Fed slides closer to “tapering,” and as the momentum on global dollar liquidity continues to drift lower and the downdraft in interest rates begins to reverse.

• Peak growth rates and inflation have been achieved, but growth prospects remain firm and the recent drop in yields reflects positioning within an uptrend that remains intact. The post pandemic risk regime is poised to adjust and this transition likely to breed higher volatility.

Another Leg Up In Risk Appetites

In our last perspective we identified emerging headwinds to equities after what has been a historic run up after the market rout in early 2020. While we argued that we expected risk appetites to remain hungry over the near term we were nonetheless surprised by its breadth since then. Over the last quarter, rising inflation expectations gave way as we hit peak inflation, interest rates fell on both government and corporate debt, the fiscal spigot remained wide open along with central bank injections of unprecedented liquidity, and within this demand for growth stocks surged, value stocks languished, and the goldilocks market for risk took another leg higher. Within this framework volatility collapsed and safe haven plays such as gold suffered. It reminded me of the novel Candide by Voltaire and his magical land of Pangloss which represented the “best of all possible worlds.” Are we in the best of all possible worlds? Will it persist?

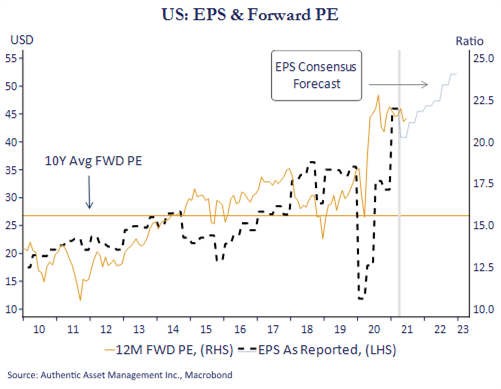

Equity markets are driven higher by profits and the value investors place on those profits. If you want to know where profit growth is going then follow GDP. If you want to anticipate what investors will pay for those profits follow inflation and interest rates, and in this cycle, liquidity. All these factors were supportive for risk appetites this past quarter. To be sure, underlying risks to growth are hard to find. Global growth prospects and those in the US are very good where GDP is set to rise by 7% this year before decelerating toward a more familiar 2% to 3% range next year. Profit growth in 2021 has almost doubled with another 14% gain slated for 2022. That feels reasonable and on point. Growth in China looks more challenging given a pronounced deceleration in credit creation that has in the past been a drag on global growth and commodities. However, that weakened impulse has been offset by fiscal and monetary policy in the developed economies. Nevertheless, we have hit peak growth and peak inflation. It represents an exhaustion of an unsustainable uptrend rather than a fundamental change in growth prospects.

The Premium On Unit Profit Growth

Much of this good growth news is priced in. The S&P 500 is already trading at a forward PE of 20.7 to 2022 earnings, and price to cash flow, price to sales, and price to revenues are 3 standard deviations above the norm. This begs the question of whether investors should be more willing to pay ever more per unit of profit growth to push this market higher? Or should they pay less?

Over the past year the premium investors paid per unit of profits and risk surged to levels not seen since the dot-com bubble of the late 1990’s. That of course was a function of central bank policies, a collapse in inflation and interest rates and a surge in liquidity. However, we also know the opposite will hold true. Investors take back that premium in periods of higher inflation, higher interest rates, and higher uncertainty. Each of these except for interest rates have turned, and in the case of interest rates we expect that to turn as well. Global dollar liquidity remains abundant, but momentum has already turned and next year will post outright declines as bond buying programs get trimmed. What emerges is not the “best of all possible worlds.” What emerges is something closer to “normal.” Investors will likely pay less.

Interest Rates Poised To Turn?

The recent rally in interest rates across all developed markets run counter this thinking. It also has some worried that it could be a sign of a more significant growth slowdown, one that would delay any change in central bank policy support, and derail rosy profit projections. We believe the fall in rates does not reflect a more negative growth outcome is being priced in. It is simply not corroborated elsewhere in the market. Corporate bond spreads are close to record tights, those rates have also rallied off the Q1 peak, cyclical stocks have strongly outperformed defensive names, and 5yr real yields are higher than they were six weeks ago. Moreover, profit growth has been steadily revised higher for 2022, not lower. Rather, the downdraft in interest rates is primarily due to positioning within an uptrend that remains intact off the lows of last year. That uptrend will be reinforced as the Fed transitions to “tapering.”

“Best Of All Possible Worlds” On Borrowed Time

A re-pricing of risk in H2 would not be the end of this bull market. It is simply a recalibration of the price paid per unit of risk, per unit of growth and like a pruned tree the market can develop a healthier core. Of course, not all adjustments are the same. In 2000 forward PE multiples collapsed from 25x to 15x over 24 months as Y2K liquidity injections were reversed and the economy slid into a modest downturn. In 2018 rate hike fears in Q4 compressed forward multiples by 3x as long rates moved up 45bps, one that was subsequently reversed by another Fed pivot. Conditions today are more like 2018. Growth prospects are good. Also, interest rates may rise but will still remain well below historical averages. That suggests price/ earnings multiples should remain above its historical averages.

Based on the above how do we benchmark any putative adjustment? Following the 2018 example, a 3x decrease in forward PE multiples from 21.5 to 18.5 (still comfortably above its long -term average of 15x) would indicate a 600-point drop in the S&P 500 is in the offing, a 14% correction to get from frothy to just expensive. This does not fundamentally alter the strength of this recovery, the path of growth, or the pace of profit growth. It is simply a healthy adjustment in what investors are willing to pay per unit of that profit growth, per unit of risk.

We know (or at least suspect) that the “best of all possible worlds” do not last in perpetuity. We also know markets feed off momentum and at some point, that momentum fades even if pinpointing that moment is always difficult. However, on the assumption that growth expectations do not disappoint, and the Fed continues to ease into “tapering” mode, it is increasingly clear that the risk regime that set in after the onset of the pandemic is now poised to adjust. With the thrust from both fiscal and monetary stimulus already fading, and without a fresh growth or productivity catalyst to alter the profit narrative, odds are rising that the next 10% move is lower, not higher.

This article is provided for informational purposes only. It is not intended to provide specific financial, investment, tax, legal, or accounting advice to you, and should not be relied upon in that regard. It is also not predictive of any future market performance. These views are presented at this moment in time and are subject to change without notice. You should not act or rely on this information without conducting proper and complete due diligence.

For more articles by the author, please visit: www.authenticasset.com/perspectives/