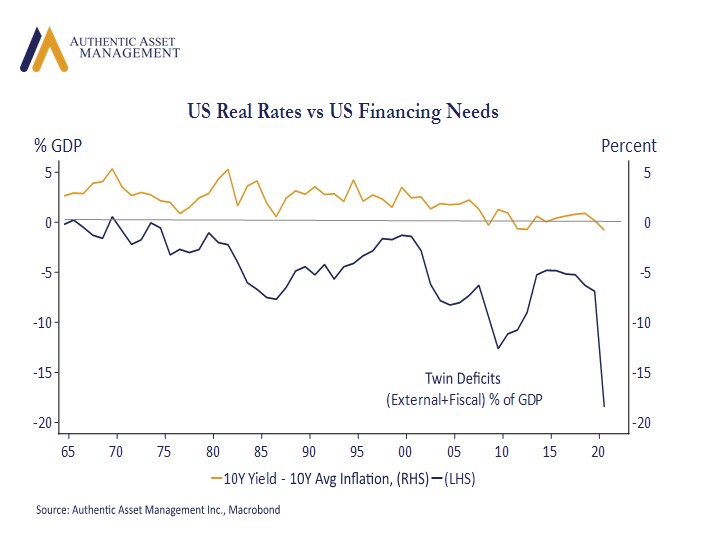

The chart gives us a different way to view potential market adjustments once Fed tapering gets underway. It demonstrates the US needs a whole lot of financing owing to bulging fiscal and external account deficits (Twin Deficits) which together have surged to almost 18% of GDP. This demand for financing would have typically forced an adjustment in either yields (higher) or the USD (lower), or some combination of the two. It is why a weaker USD was a consensus bet at the beginning of the year. Thus far, no adjustment has taken shape thanks to the heavy hand of the Fed. After all, why borrow when you can simply print money. The question is what happens next?

US financing needs may improve but I would not bet on a seismic improvement. Growth in the US is running ahead of global GDP suggesting external deficits will remain large. Moreover, I don’t see much fiscal discipline coming out of Washington anytime soon. If the Fed’s monetization of the deficit begins to shrink will the USD adjust lower, or will real yields adjust higher?

#investing #markets #economy #portfolio

For more Insights by Authentic, please visit: https://authenticasset.com/insights/