Quarterly Perspective Q1 2024 January 09, 2024

• Our mantra over the past year has been one of caution, to pick your entry points and manage beta risk with a tight rein. That has not changed.

• Upside growth surprises that dominated in 2023 are not likely to be repeated in 2024. Weaker growth and earnings profile relative to expectations may provide desired rate relief, but it comes at a cost not adequately priced in.

• Rate cuts, greater clarity on the growth front, and calendar decay that puts stronger 2025 earnings into focus point to stronger risk appetite in late 2024. For those looking to position for that strength it is best to hurry up and wait for more attractive entry points.

Still Stuck in Transition

Coming into 2023 the prevailing view was that the coming year would be one of transition. One transition was to be a transition to lower inflation. The other was to be a transition to significantly lower growth and or recession owing to the cumulative effects of tighter monetary policy around the world and with it potentially lower interest rates on more dovish central banks and lower inflation. Risk appetites were set to fare better in 2023 relative to 2022 but remain bound to a weakening economic outlook. Instead, 2023 was a year of surprises. Economic growth surprised significantly to the upside, and with inflation receding as expected, expectations of a soft landing coupled with lower rates set the stage for a banner year for equities and despite rising policy rates modest gains in high yield and investment grade fixed income.

The question for us as we move into 2024 is whether we will again be surprised by stronger growth and a goldilocks scenario for equities where a soft landing, or no landing, together with lower interest rates breed upside surprises for risk assets. That remains a distinct possibility, but we believe over the first half of 2024 it is also the lower probability outcome. Our mantra over the past year has been one of caution, to pick your entry points and manage beta risk with a tight rein. That has not changed. The global economy has proved very resilient over the past year, and the odds of a deep recession are low, but we remain more negative on near term growth prospects, in both Canada and the US. The factors that created upside surprises to growth are now fading. Ultimately, the market follows economic fundamentals and lingering within this bullish 2023 narrative is a fundamental picture that was poised to become more problematic, perhaps significantly so. Over coming months, it is this less supportive economic backdrop that will be the primary driver of risk assets and is likely to disturb the low volatility grip on markets priced for perfection on growth, inflation, and central bank policy.

Growth Surprises To Fade

Forecasting how economies evolve over periods of time is no easy task and differences of opinion are precisely what make markets function as they do. Today opinions vary greatly, but the prevailing view is coalescing around a soft landing or what is now being termed a “no landing.” Such a scenario will keep earnings growth on track and push rates lower as inflation recedes and as central banks cut rates which they must as inflation creeps closer to the 2% target. It is a goldilocks outcome rarely achieved. That the current tightening cycle has pushed rates above the peak in the prior cycle for the first time in 30 years also carries added risks. It would suggest that the refinancing stimulus from a recalibration in rates will require a more significant reduction in borrowing costs than prior cycles. Stated differently, the growth effect from refinancing is more difficult to achieve given the large pool of existing low yielding debt already in place.

Stronger than expected growth and peak in policy rates has no doubt nurtured the expectation of a gentler outcome to this tightening cycle. A similar pattern was in play in 2008 when consensus opinion was for a soft landing. Our own view is more cautious. In 2023 a host of factors kept growth better than expected, at least in the US. These include the lagged spending impact from swollen fiscal stimulus. That impulse, or the change in the magnitude of the spending, was decidedly positive in 2023 and turns decidedly negative in 2024. Another factor has been the residual buildup of Covid surpluses among households, but with savings rates now below pre-Covid levels that too will become a more obvious headwind as labor markets slow from the blistering pace of the past year.

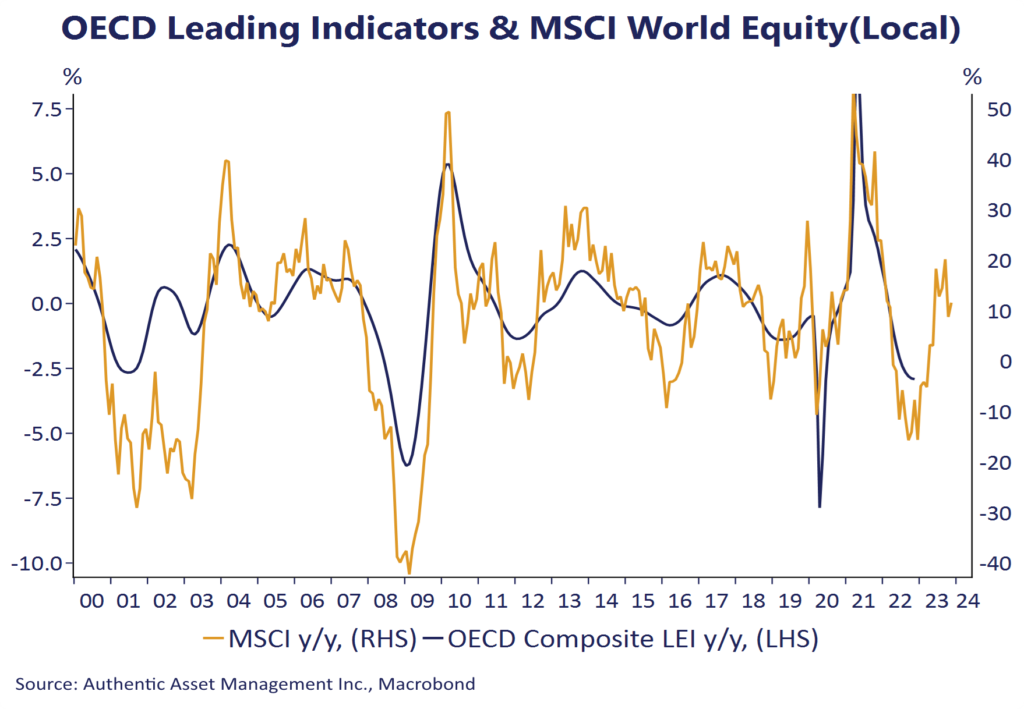

Upside growth surprises that dominated in 2023 are not likely to be repeated in 2024. A litany of economic indicators that have been pointing to slower growth now assume even more relevance. Purchasing manager surveys have been in contraction territory for 14 months, the index of leading economic indicators has fallen at a rate that has always preceded recessions, and the flow of credit has begun to contract as lending standards have tightened. Capital investment plans among firms have also fallen sharply. When aggregated together, many of the key elements of GDP including fiscal spending, consumer spending, and business spending are poised to slow, in some cases considerably. The view that this time is different may well prove correct, but there is little evidence in how the data is evolving to suggest that will be the case. It is a message similar to the downtrend in commodity markets and bond yields more broadly.

Lower Rates Coming

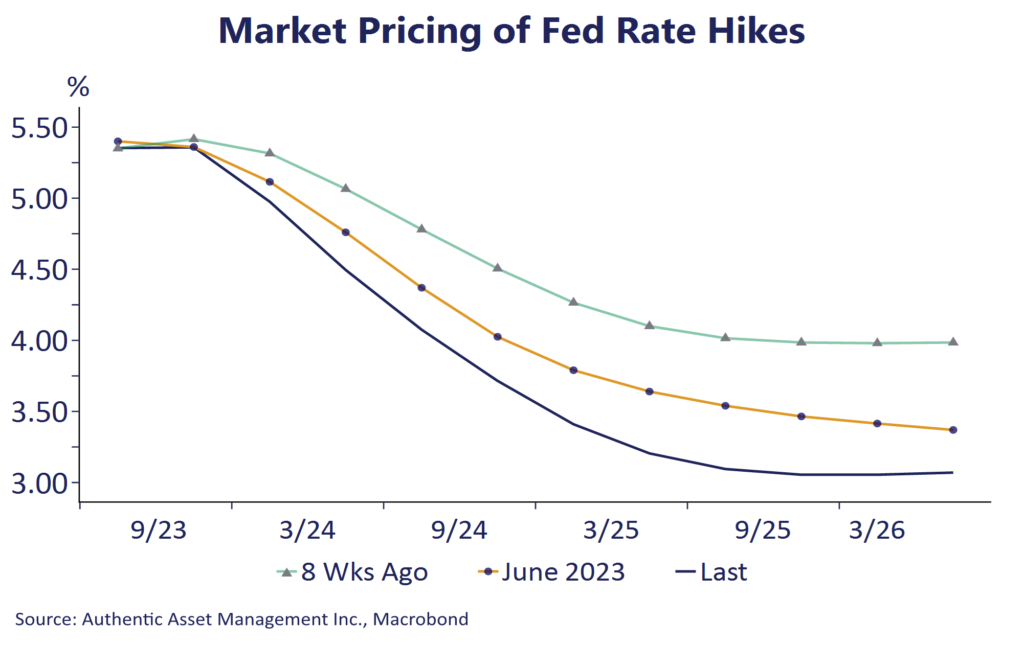

Weaker economic growth and lower inflation spell lower rates. The good news is that inflation is falling faster than expected and the underlying guts of the inflation system are firmly disinflationary. Moreover, the notion among policy makers that achieving lower inflation required a level of destruction in the labor market is losing steam. Gone also are the supply bottlenecks of the Covid era. It is worth noting that central bank credibility remains intact with inflation expectations, in 5y and 10y sectors as well as 5y5y forward measures back to pre-covid levels. In effect, the market forgives the Fed (and others) for their post Covid monetary inflation lapse. This is all a positive set-up for a market priced for a pivot to lower rates before mid-2024. As seen in Chart 2, those expectations have moved considerably with the market expecting an additional 75 bps in easing relative to the view just two months ago.

Expectations for a rate cut by the end of Q1 look very stretched as does a market priced for almost 6 rate cuts in 2024. We would not expect any rate cut prior to mid-2024 and likely not more than four 25 bp cuts in 2024. A lingering risk to market expectations for lower rates is that inflation today is simply high relative to the trend of the past several decades and where it settles remains open to debate. We suspect the market will be proven mostly right, however, but for the wrong reasons. In our view it is weaker than expected growth that precipitates a series of rate cuts in 2024, and less than the market now expects. It is that weaker growth and earnings profile relative to expectations that may provide desired rate relief, but it comes at a cost not adequately priced in.

Choppy Market Outlook

The year ahead looks to be a choppy one likely front loaded over the first three quarters. A de-inversion of the yield curve coupled with rate cuts will benefit cyclical sectors such as financials assuming the downturn is shallow in scope, but equity markets face several near-term hurdles. Sluggish growth relative to expectations, an ongoing compression in profit margins, the ongoing decline in liquidity from QT, potentially wider credit spreads, refinancing risk among smaller companies, and the view that we enter 2024 at a forward PE on the S&P 500 of 20X. Taken together it would suggest that equity markets risk trading lower over the first half of 2024 with the next 10% move down, not up. We suspect 2024 earnings estimates on the S&P 500 at $240 remain too optimistic and something closer to $225 to $230 is more reasonable. Over the near term, therefore, we remain defensive in how we manage our beta risk and look for more attractive entry points into risk assets. If greater uncertainty and weaker growth were to push multiples down to 18 attractive entry points for the S&P500 would be 10% below current levels. Rate cuts, greater clarity on the growth front, and calendar decay that puts stronger 2025 earnings into focus point to stronger risk appetite in late 2024. For those looking to position for that strength it is best to hurry up and wait for more attractive entry points.

Eric Green