• Our near-term outlook remains bullish, but our sentiment has been trimmed despite growth prospects for the current year that remain outstanding.

• Future headwinds to risk appetites are beginning to crystallize. The move higher in equities may persist over the near term, but we suspect that it is the underlying move higher in borrowing costs and shifting inflation risks that will prove more permanent.

• This introduces more uncertainty into unidirectional equity markets. It suggests the volatility of returns is likely to drift higher and with it a growing challenge to match the returns most investors have become accustomed to.

In our last quarterly perspective, we observed that equity markets may be expensive by virtually all traditional valuation metrics, but there was no reason to presume a change in sentiment anytime soon. This “Bubblicious” market would persist in 2021. Surging money supply and liquidity has needed an outlet, one found in a myriad of risk assets including the SPAC phenomenon, and with an end to the pandemic in sight and growth prospects for the current year promising, it has been hard to pinpoint when the bid for risk is likely to turn. Moreover, we are in the early stages of a new business cycle. Rates remain low in real and nominal terms, liquidity will remain abundant, and fiscal policy support will persist. In Q1, risks appeared to recede and with-it volatility.

It seems paradoxical that this good news and evidence of policy success should breed uncertainty, but it will. Future headwinds to risk appetites are now beginning to crystallize. The move higher in equities should persist over the near term, but we suspect that it is the underlying move higher in borrowing costs and shifting inflation risks that will prove more enduring. That has significant implications for projected returns, allocation decisions, and ultimately the central bank support upon which much of the reach for risk since the March 2020 lows has been built.

Evidence of Policy Success…

The post pandemic economic environment will provide an opportunity for earnings to grow into the lofty expectations already priced into the market. We are optimistic on economic growth in 2021, and the US stands out in this regard. The vaccine effort has become, ironically, the envy of the world and the re-opening theme further along than elsewhere. Central bank support appears firm, credit spreads remain at cycle lows and fiscal support has not only plugged the demand deficit that emerged in 2020 it has done so by a factor of 4 to 1. With the expectation of more infrastructure spending in the pipeline we can expect fiscal policy to be a tailwind to growth for several years.

Food and energy prices may be heading higher but the share of spending out of household budgets is at multi-decade lows. Job growth is accelerating, household net worth is at record highs, and savings balances magnitudes higher than usual owing to covid relief. In effect, enormous pent up private demand, and the means to finance it, is being uncorked and at a time of unprecedented fiscal stimulus. The fundamentals greeting a global economic re-opening are not just robust. They are extraordinarily robust.

…Breeds Mounting Tension

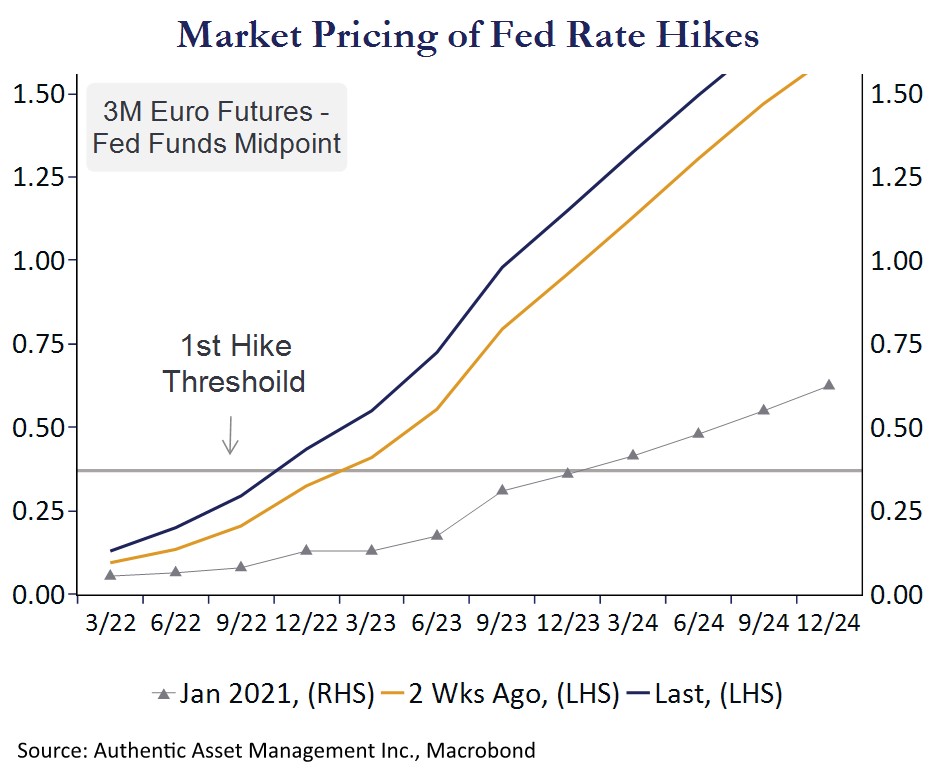

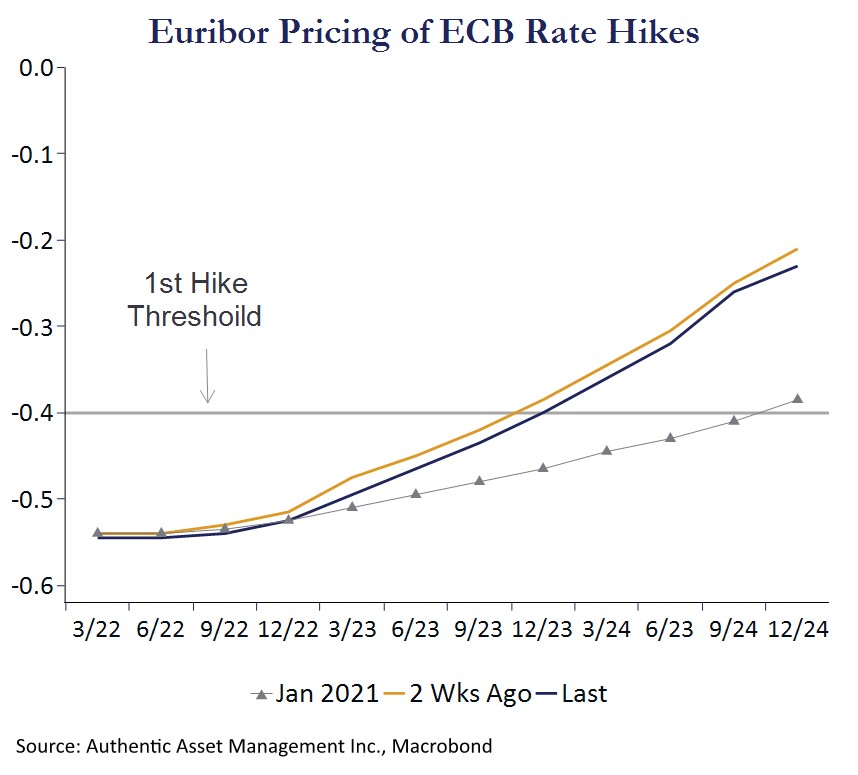

A corollary to this policy success of stronger growth and fading disinflation risks are rising borrowing costs and a growing unease on how long central banks will keep monetary spigots at full stream. Since January 1 market expectations for the timing of the first-rate hike by the Fed has moved from early 2024 to late 2022. That is a heroic shift in expectations. (Chart) Expectations for the timing of the first rate hike by the ECB has also shifted, but relative to the US the pace of tightening and the level of tightening is of an order of magnitude different. (Chart) That wedge has been widening on the back of the outsized fiscal support and successful vaccine roll out in the US relative to the Euro area and is a primary reason expectation of a weaker USD have failed to materialize.

To varying degrees, interest rates are on the rise across the major economic blocs, and along with it a steepening of yield curves. This optimism is also evident in the mix of factors driving rates higher. Rates minus the inflation premium, or real rates, have bottomed and are now drifting higher on stronger growth expectations. It is not emblematic of deteriorating credit quality among governments on a borrowing binge (otherwise those real rates would not be at record lows). It is emblematic of expectations for higher short-term rates controlled by the central bank, and these are now considerably higher than expected 3 months ago.

Post Pandemic World—Growing Challenges

Equity markets are a discounting mechanism. It distills an expected state of the world and discounts the value of that future state into prices today. As interest rates move higher the value of future earnings will diminish. That in turn makes current equity valuations appear more rich, not less. Borrowing costs will remain low, but drift higher – liquidity will remain ample, but drift lower – and inflation will remain low, but it too will drift higher.

We do not know how high inflation and or interest rates will go, but we know those risks are tilted higher. We also suspect growth in 2022 will also be lower and at a time when monetary and fiscal support will be fading. Clarity on earnings growth in 2021 will likely give way to more uncertainty on earnings growth in 2022. Taken together, this introduces more uncertainty into what has been unidirectional equity markets. It suggests the volatility of returns is likely to drift higher.

The post pandemic economy greets asset allocators with new challenges. The grab for risk has plucked the low hanging fruit and while long term interest rates have moved above the S&P dividend yield, the risk of higher rates carry as much potential for capital loss as it does an offset to risk.

As the growth deficit from 2020 is filled and central bank support adjusts, the real return on most assets is likely to diminish. High valuations that pulled forward strong earnings growth are one reason, but others that include massive private and public debt loads, weak productivity growth, aging demographics, rising inflation and borrowing costs are also important. Generating strong absolute returns in this post pandemic world will be more challenging. Doing so while mitigating downside risks puts a premium on discipline and creativity.

This article is provided for informational purposes only. It is not intended to provide specific financial, investment, tax, legal, or accounting advice to you, and should not be relied upon in that regard. It is also not predictive of any future market performance. These views are presented at this moment in time and are subject to change without notice. You should not act or rely on this information without conducting proper and complete due diligence.

For more articles by the author, please visit: www.authenticasset.com/perspectives/