An interesting question to ponder given the massive rise in interest rates is what the impact has been on corporations and inflation, and whether it might present a clear and present danger to the economy. In the US case, a most benign starting point suggests the answer is not much yet and no.

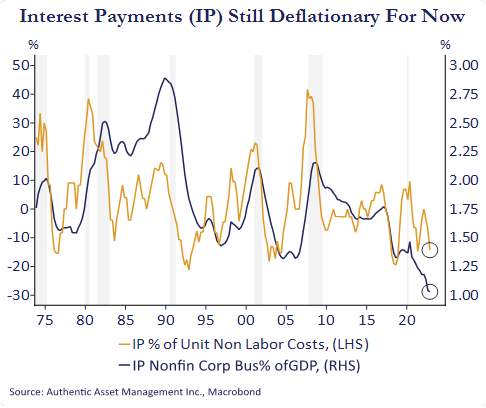

What we see in the chart are interest payments by nonfinancial corporate businesses ($275B) as a percent of GDP (1.1%). That latter figure is a 50yr low, and well below the average of 1.6% since 2000 and the 2.0% average in the period 1980 to 2000. When we view this in the context of inflationary pressures, that is looking at the share of interest payments in unit non labor cost data, we find those costs are falling at a 14% rate y/y. Viewed this way, the rise in interest rates have had little to no impact on corporate balance sheets.

Of course, that will change. Higher rates have not yet been reflected in this data because most CFO’s termed out company liabilities with low borrowing costs. However, approximately 22% of this $13 T in debt is rolling over within one year and that is a big number. But its impact is not the stuff of Armageddon. If we double the average rate of interest on that debt to approximately 6% the net increase in interest payments as a % of GDP rises toward 1.5%, or close to the average since 2000.

We continuously talk of lagged impacts from policy tightening and, in this case, the lagged impact looks to be reasonably benign based on the rate regime in place today. That added cost to company balance sheets will dent hiring and capital expansion plans. However, it will not in and of itself derail the economy.

What is lost in the data, however, is the outsized impact on small businesses who will pay the brunt of the rise in rates. Small businesses have a proportionately higher level of floating debt and don’t have the same access to capital markets as large companies. They rely more on regional and community banking relationships.

With lending standards getting squeezed higher, access to capital at an acceptable cost is likely to become more difficult. This has negative implications for some equity indices such as Russell 2000 relative to others such as the cash rich Nasdaq 100.

#AuthenticAsset #portfoliomanagement #investment #banks #hedgefunds #alternativeinvestments #fedpolicy #hedging #growth #assetmanagement #fedpolicy #recession #bondmarket #diversification #liquidity #risk