• Our view of a recession in H2 2023 remains intact, but in the aftermath of the mini banking crisis in the US and Europe those risks have now shifted further to the downside. That has significantly altered market expectations for interest rates and monetary policy.

• The key question is no longer where peak policy rates will settle. It is now centered on whether central banks will be cutting rates, and by how much. Market expectations for rate cuts continues to feel quixotic in the absence of a significant downturn not yet priced into equity markets.

• Equity markets will remain volatile in the aftermath of higher banking instability and rising economic risks. Earnings estimates are still too high as are multiples despite a significant re-pricing of interest rates.

Peaking Around A Sharp Corner

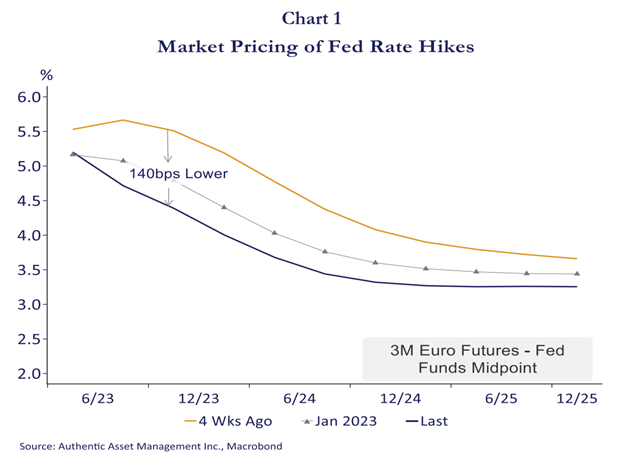

Relative to the start of the year much remains familiar. Inflation continues to recede over the peak, economic growth has proved resilient, and central banks remain hyper vigilant. Relative to where we were just one months ago, however, a good deal has changed. Our view of a recession in H2 2023 remains intact, but in the aftermath of banking sector stress in the US and Europe those risks have shifted further to the downside. That has significantly altered market expectations for interest rates and monetary policy. This can be seen in Chart 1 above. It shows that current market expectations for Fed policy rates are approximately 140bps lower than just 4 weeks ago. That is a massive move in a short period and at a time when, at least at face value, the inflation data (and growth numbers) would argue for ongoing vigilance, not less.

One of our ongoing views has been that market expectations for aggressive Fed easing have bordered on exuberant, and even if proved correct, it would imply a negative growth outcome yet to be priced into the markets. That view persists. The key question today is how much of a risk is that negative growth outcome, what will its impact be on equities, and whether inflation will recede fast enough for central banks to recalibrate their fight against inflation.

Economic Risks On The Rise

The growth backdrop for 2023 never looked very robust. Many expectations centering around something just north of stall speed to something slightly higher. The risk of a more negative outcome has now risen. That is due to weaker bank credit conditions in the aftermath of the SVB and Signature bank failures, and to a lesser degree from the forced consolidation of Credit Suisse into UBS. At face value one might think that these are isolated failures and should not fundamentally shape the broader economic trajectory. However, these events will restrict the flow of credit in the economy. Smaller community banks in the US account for approximately 40% of total consumer and commercial lending and these banks will be rewarded for being conservative, hoarding reserves, building up balance sheets and simply lending less. That will not be offset by higher lending from well capitalized money center banks. In effect, these failures create a negative feedback loop that amplify a volume of monetary tightening that is only now slowly making its way into broader economic activity.

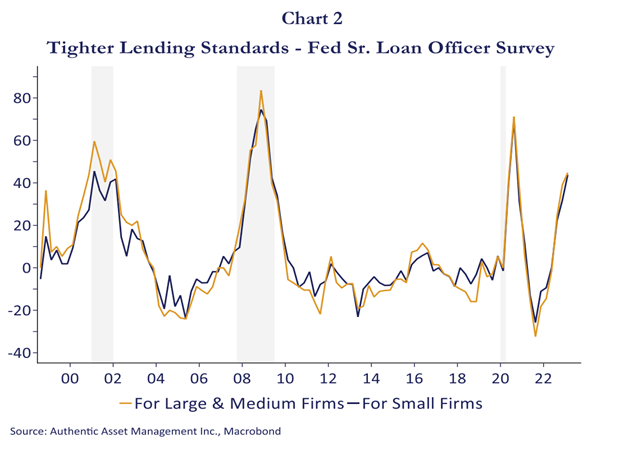

As seen in Chart 2 above, bank lending standards were already showing signs of getting considerably tighter even before the onset of the bank failures. That will tighten considerably more going forward. These realities converge at a time when two key factors supporting economic strength are giving way. The excess savings padding consumer balance sheets are now depleted for all but the highest quintile of households. The job market does appear unusually strong. However, odds are high that weaker economic growth after a weather induced surge will dent job strength over coming months. Layoffs have risen sharply, business hiring intentions have fallen, and firms reporting jobs hard to fill has fallen to multi year lows. Weaker economic growth is not a heroic forecast. Leading economic indicators in the US and elsewhere have fallen sharply at a pace and duration that has always resulted in a recession. The same might be said of the inverted yield curve. It is worth emphasizing that a recession is not guaranteed. It is, however, more likely than it was several months ago.

Central Banks – Gauging The Turn

In March the ECB, BoE, and the Fed continued to roll ahead with rate hikes. That was unusual, even if the risk of further contagion looks muted for now. Central banks generally take a more cautious approach into a potential banking crisis, but it has also been unusual to remain so hawkish despite telling signs of an impending recession. It speaks volumes to their preoccupation to fight inflation. The BoC stood out in the decision to hold rates steady. That was driven in part by a transmission mechanism into an economy that feels more immediate and risky given household debt at 185% of disposable income is by far the highest among G-7 nations. That pause does feel prescient, however. Just as the BoC led the charge in raising rates, they are leading the way in getting to peak policy rates. The debate is now shifting. The key question is no longer where peak policy rates will settle. It is now centered on whether central banks will be cutting rates, and by how much.

That question has been clarified by recent bank volatility. It is hard to know how much tightening a reduced flow of credit into the economy is worth in policy terms, but the market view is that it is worth approximately 140bp to the Fed in 2023. This we get relative to expectations just one month ago. It implies approximately 75bps of easing from the current policy rate by year end. Whether the market is correct remains to be seen. What is more certain is that being right will require a more significant economic downturn than is currently priced into equity markets. This has been a familiar market inconsistency. It reflects a market penchant to be considerably more dovish than the central bank.

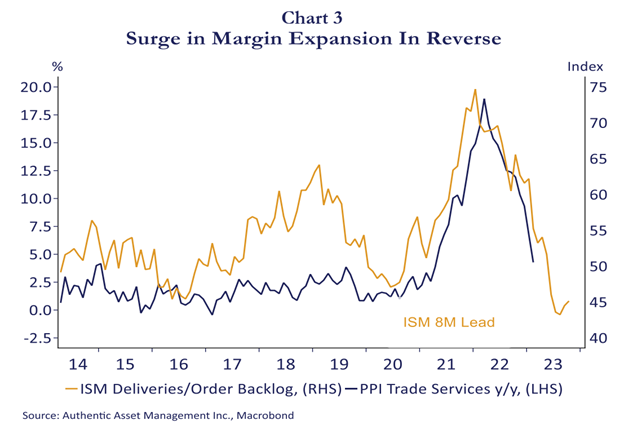

The good news is that the underlying trend on inflation is more benign than Fed rhetoric would suggest. All the key pillars that drove inflation higher are rolling over. As seen in Chart 3 above, the supply side pressures that drove inflation and operating margins to multi decade highs are in fast retreat. At the same time, energy and food commodities are falling in y/y terms, wage growth is decelerating and will continue to do so as job growth slows, and shelter inflation is set to slow sharply into next year.

US Core CPI inflation is likely to decelerate from 5.5% y/y to 3.5% y/y by the end of 2023. It means further policy tightening is not needed. Even if rates do not go higher in nominal terms, in real terms policy will become significantly more restrictive, or by 200bps in the above scenario. However, since the pace of inflation remains well outside the 2% definition of price stability, it also means the type of aggressive response anticipated by the market is unlikely, and only achieved by a hard landing. Those risks are rising, but as of now we suspect the economic fallout will not be sufficient to give Doves the upper hand.

Equities – Recession Risk Rising

Equity markets gained traction in the early months of the year on hope of a soft economic landing. That idea is under pressure. This has been reflected in underperformance in the small cap Russell 2000 which is most vulnerable to weak growth and in a change in equity market leadership from value back to growth stocks benefitting from a strong tailwind of falling interest rates. On balance, however, the broader market, is still vulnerable to further setbacks.

Downward revisions to 2023 EPS estimates have become a constant occurrence and more are in the offing. We expect S&P500 earnings, currently revised down to $225 per share (from $249) should fall toward $215 or lower as growth disappoints. If one believes a multiple of 17x earnings is reasonable then fair value feels closer to 3650, or approximately 7% below current levels. The bottom in equity markets is always an elusive call, but the direction continues to feel more certain.