Peak Policy and Surging Equities

FOMO (fear of missing out) may well be contributing to the recent rally in equities that has pushed forward multiples higher and higher despite a Fed that has tightened policy at the fastest most pronounced rate in 4 decades. History suggests this is not a bad move. On average, over the past six tightening cycles, the S&P500 rallied over 15% in the first year after the Fed stopped raising rates. A big reason for these gaudy numbers is that the Fed, on average, quickly cuts rates after that last rate hike. On average, the first-rate cut was a matter of a few months.

A similar expectation has been playing out today with the market priced for a series of rate cuts beginning in mid-2024. That may well happen along with another strong rally in equities. After all, a soft landing remains a distinct possibility, and for some a distinct probability. However, the risk is that rate cuts do not materialize as expected, rates stay higher for longer, and earnings estimates suffer as growth underperforms amid tighter financial conditions. The primary risk to the market-based scenario is inflation, no real surprise there. I would make two quick points, however.

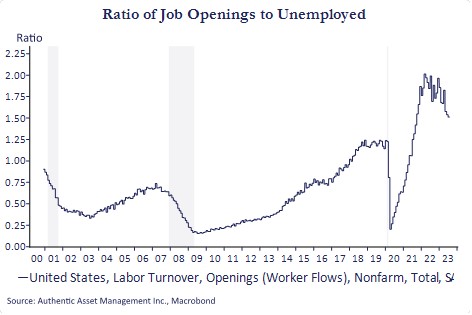

The first point is that core inflation momentum remains significant and persistent in most economies. This persistence is underpinned by tight labor markets, and in the US it is not just unusual, it is extremely unusual as seen in the chart. The chart shows the ratio of job vacancies to unemployed people. That ratio is moving modestly lower and will continue to do so, but it is emblematic of a job market that has remained remarkably robust and with it the consumer. This excess job demand must be worked off before fear that the putative risk to inflation from a step higher in wage inflation will recede. That could delay the timing of any rate cuts next year, or beyond.

The second point is that inflation today is simply high relative to the trend of the past several decades. That rate is moving lower and will continue to do so, but if core inflation remains close to 3% in mid-2024 will the Fed cut rates to fine tune an economy when they are 100bps above target? If core inflation is 2.5%, will they cut when excess demand for labor yet to be fully worked off? Perhaps, but the risk is that they don’t, not without a more serious economic downturn. That may precipitate the desired rate relief, but at a cost that would ensure history would not repeat itself.

#AuthenticAsset #portfoliomanagement #investment #banks #hedgefunds #alternativeinvestments #fedpolicy #hedging #growth #assetmanagement #fedpolicy #recession #bondmarket #diversification #liquidity #risk