Anatomy of Reversal – The FOMC

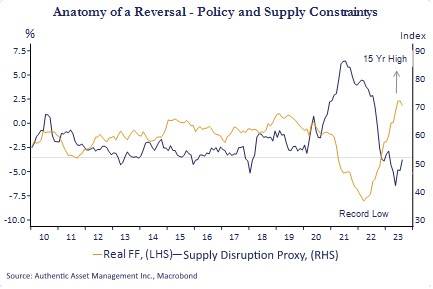

When the Fed first began raising rates, we published this chart highlighting that the Fed was late to fighting the inflation problem that was initially set in motion by the supply bottlenecks stemming from the Covid epidemic. Supply side price pressures were at record highs and demand driven pressures were soon to follow. Today we are showing that same chart to demonstrate two points. One is to illustrate the progress made in the current tightening campaign. Real fed funds policy rates have risen from a record low of -7.5% (twice as low as the preceding record low) to a fresh 15-year high. That’s solid progress. The other point to highlight is that this preaches caution for the FOMC. The meeting next week should and will conclude with no action by the Fed, and that another rate hike is akin to unnecessary overkill in a process that will take many quarters to play out.

A similar expectation has been playing out today with the market priced for a series of rate cuts beginning in mid-2024. That may well happen along with another strong rally in equities. After all, a soft landing remains a distinct possibility, and for some a distinct probability. However, the risk is that rate cuts do not materialize as expected, rates stay higher for longer, and earnings estimates suffer as growth underperforms amid tighter financial conditions. The primary risk to the market-based scenario is inflation, no real surprise there. I would make two quick points, however.

Real policy rates will continue to move higher as inflation slowly but steadily rolls lower in the coming quarters. The Fed can leave rates unchanged and with a decline in headline CPI to approximately 2.75% by mid-2024 effectively tighten another 100bps. To be sure, where inflation settles remains highly uncertain. However, that uncertainty is more relevant to the putative easing cycle the market has priced forward. What is more certain is that policy, already very restrictive, will become more so over the coming months and without any change in policy.

Economic growth has been surprisingly strong in 2023. Part of that may be attributed to stubbornly supportive fiscal ‘injections working at cross purposes to monetary policy, residual strength in Covid era balance sheets, and strong labor markets. However, we know the follow-through from higher rates into economic activity takes one to two years which means there is a great deal of tightening yet to make its impact. Real yields in the TIPs market have increased almost 400 bps (5-year maturity) to the highest level since 2008. In an economy saddled with a record level of debt these higher rates will eventually bite. The Fed is advised to leave well enough alone until it does.

#AuthenticAsset #portfoliomanagement #investment #banks #hedgefunds #alternativeinvestments #fedpolicy #hedging #growth #assetmanagement #fedpolicy #recession #bondmarket #diversification #liquidity #risk