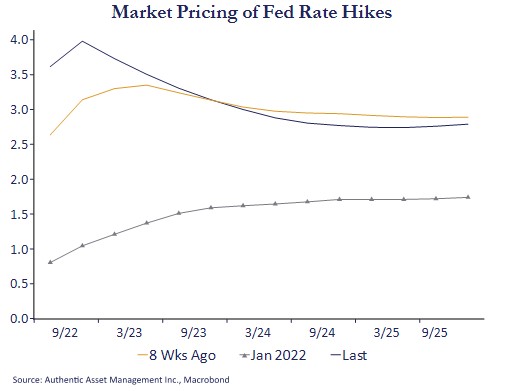

Several interesting conclusions stand out from the chart graphing market expectations for Fed rate hikes over the current tightening cycle. The first is that the miss relative to where the market expected rates to be in January of this year at the end of 2022 is almost 300bps. That is a whopping miss, and it reflects a Fed that was slow to move aggressively on inflation that has since that time continued to surprise to the upside.

The second interesting conclusion is that the market (and Fed) continues to play catch-up to current inflation readings which has pushed the peak in rate hikes up another 75bps. The market gauge of Fed intentions is pricing rate hikes not where they should be, but where they believe a scrambling Fed will push them in reaction to recent (and backward looking) inflation data. This we can see in the market pricing in more rate hikes this year relative to expectations two months ago, but with an end point in 2023 that is lower than what was thought would be the case two months ago. This leads to the third interesting conclusion.

That is — the market is pricing in overtightening by the Fed. The market sees the Fed cutting rates by over 100bps next year which feels astonishing as 2023 is only 5 months away and the chatter today is whether the Fed follows the BoC and raises rates by 100bps. It feels like a redux of the mid-1990’s tightening cycle which, I am pleased to point out, was a happy ending for everybody. That type of rate profile may happen again, but it reflects hope that the landing being engineered for inflation and growth will be a good one. Let’s hope the market is right!

#AuthenticAsset #portfoliomanagement #investment