• The re-valuation across equity and fixed income markets has been deep and painful over the prior quarter, but multiple compression and a forming peak in the inflation cycle provides some optimism that much of the adjustment to lower equity valuations, higher rates and inflation is near completion.

• More downside is in store for equity markets as earnings estimates get revised lower, but a recession is likely to be avoided in 2022, and in nominal terms certainly so. A move towards 3300 on the S&P is in reach, but the second half of 2022 will feel less painful than the first half, especially for fixed income.

• As the cyclical adjustment unfolds in response to tighter financial conditions, secular headwinds are likely to present more enduring challenges to growth and equity investors.

Taking Stock of the Shock

Our last Quarterly Perspective began with “Cheers to Tears” and presaged much of what transpired over the past quarter. Equity markets took another beating and fixed income markets provided little respite with investment grade, sovereign debt, and high yield bonds all down on the quarter. The factors driving this re-valuation are well known. High inflation has accelerated the end of easy money regimes and the withdrawal of this stimulus, both by central banks and on the fiscal side, continue to feed a heavy dose of market indigestion, and with little room to hide outside of cash. What is less well understood is how much more pain lies ahead. Nobody has a perfect crystal ball and part of the answer is how deep we are in an adjustment relative to expectations for inflation, growth, and by extension central bank policies. On this, there is some room for optimism. But it also feels like a good news bad news story. We will leave it to the reader to determine if the glass is half full, or empty.

Cyclical Adjustments—Almost There

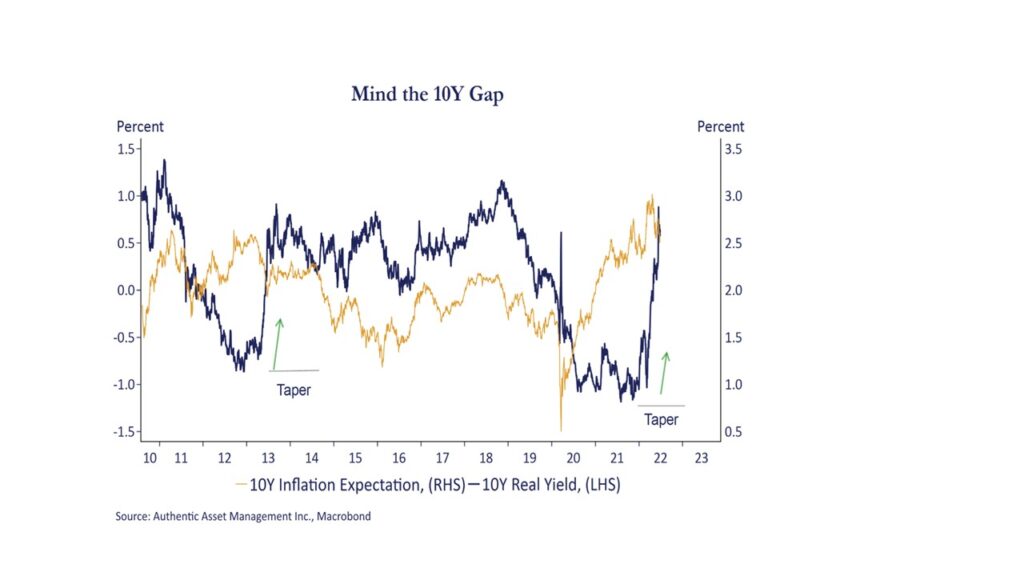

First the good news and we will use the US as a proxy for broader global markets. The re-valuation across markets has been deep and swift, but the record from past cycles is encouraging. Since 1990, longer term equity performance was positive through tightening and cutting policies with one lone exception, the post dot.com bubble burst of the early 2000’s. Today a good deal is priced in. As seen in the first chart, the expected rise in interest rates has materialized as shrinking central bank balance sheets precipitated the correction in real rates we had anticipated. With that adjustment near completion, and an aggressive Fed priced in, there is scope for some upside surprise in rates (lower yields) as the inflation premium recedes. In fact, over the past 6 weeks inflation expectations have plunged approximately 40bps.

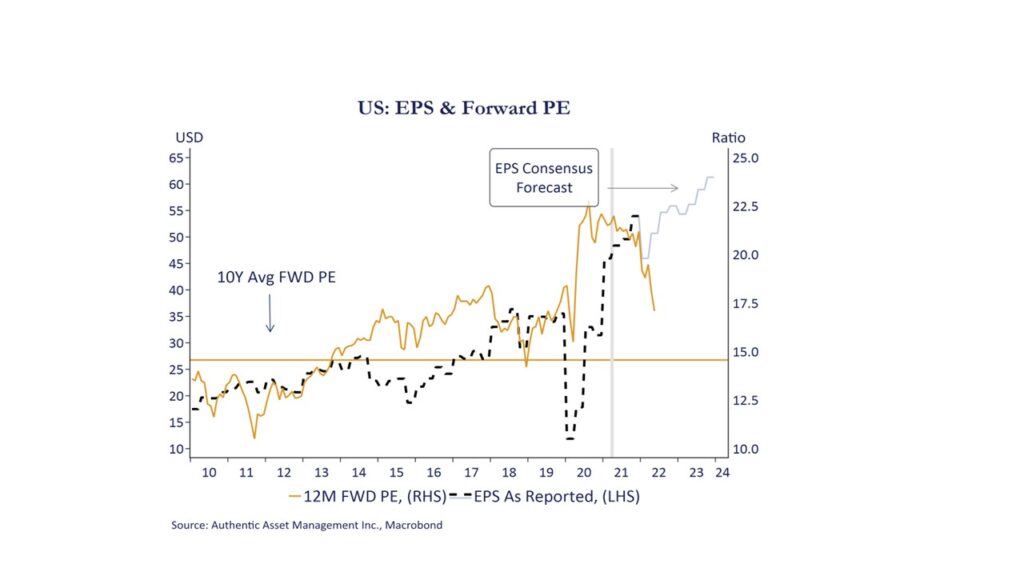

The S&P 500 has fallen into bear market territory, an adjustment driven exclusively by multiple compression. Forward PE’s on the S&P 500 have fallen from a peak of 23 last year to approximately 15 based on 2023 earnings expectations. That is now consistent with its longer-term average which is good news. At face value, therefore, it would appear much of the adjustment in broad equity markets, and fixed income as well, feels close to completion.

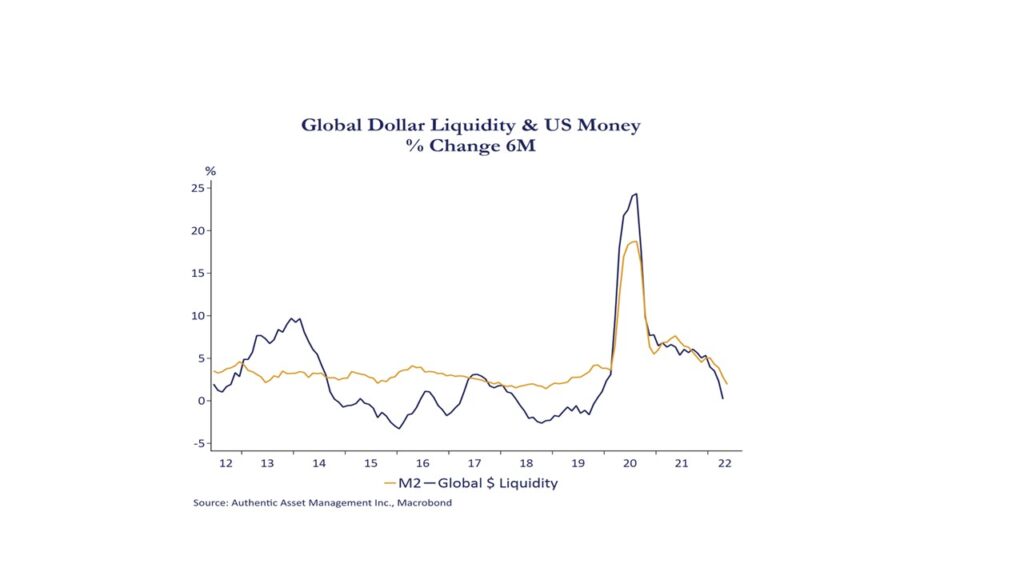

Now the bad news. We can sum this up in three words: Earnings—Inflation—Liquidity (or lack of it). As seen in the chart above, global dollar liquidity is moving sharply lower. This is being manifested in bond markets where liquidity has dried up, and in equity markets as dip buyers are gone and the easy money that fueled the “buying of everything” dries up. This creates the scope for an overshoot to the downside. Earnings are also too high and have not yet come down as economic growth expectations diminish as seen in the chart below.

Multiple compression may coalesce around 15x earnings, but if earnings for 2023 at $247 on the S&P 500 are conservatively reduced 7% to 10%, then another drop in equities toward 3300 is probable. Finally, inflation may continue to surprise to the upside. This would exert more pressure on the Fed, more upward pressure on real rates, and more upward pressure on inflation expectations which in turn creates more downside for risk assets.

Cyclical Outlook—Glass Half Full

Inflation remains the key variable. Our view is that it has peaked, and inflation fears will recede. This can be attributed to easing of supply constraints (evident), easing of commodity prices (evident), weaker momentum in hourly earnings growth (evident), and base effects to suggest a few. Inflation will remain too high and a roll over toward 4.5% y/y in 2023 is not price stability, but the direction does set a new trend. That takes the pressure off the Fed to deliver more than is priced in, and suggests the recent peak in rates, or something close to it, will hold. Growth expectations will continue to recede, but we likely avoid an outright recession in real terms, and most certainly in nominal terms. That means earnings do get revised lower, but closer to 8% rather than 20%. Together, it suggests more volatility lies ahead, and more downside for equity markets toward 3400. However, put another way, it means the correction in equities is 80% complete, and fixed income outside of high-yield close to 95%. If we are right, the second half of 2022 will feel less painful relative to the first half.

Secular Headwinds Will Likely Persist

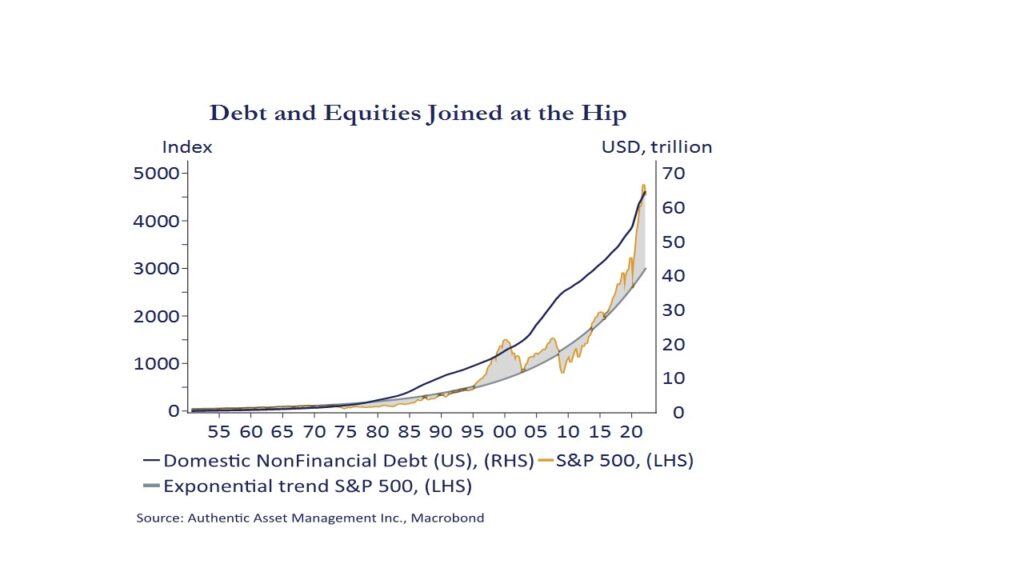

A longer-term view on debt and equities in the chart below highlights a more secular challenge to growth and risk assets. Debt accumulation surged and with it the value of the S&P 500 in absolute terms and relative to its long-term trend which is otherwise also moving sharply higher. Borrowing greased the tracks for growth above what it otherwise would have been and along with-it equity markets, supported by multiple expansion and strong profits. It all worked provided inflation was tame. Now it is not.

The prevailing wisdom is that this accumulated debt will prove disinflationary to the broader economy. There is some elegance to this logic, and it is supported empirically by a coincident 40-year period of disinflation from which we are emerging. Debt will continue to be accumulated, but that pace will likely establish a new lower baseline relative to its 40-year trajectory. The Fed will hope this proves disinflationary, but at what cost? At what cost to growth, jobs, and corporate earnings as the rising cost of money diminishes the incentive to accumulate more debt to finance consumption and investment at a pace akin to recent decades. These challenges are converging at a time when de-globalization, aging demographics, and tepid productivity growth become more of a secular tailwind to inflation and less and less supportive to economic prosperity. The chart illustrates a trajectory of debt and equity markets emblematic of an old paradigm now in transition. I don’t know what that new paradigm will look like. My instincts tell me it will be different, and less rewarding to equity investors than the last one.