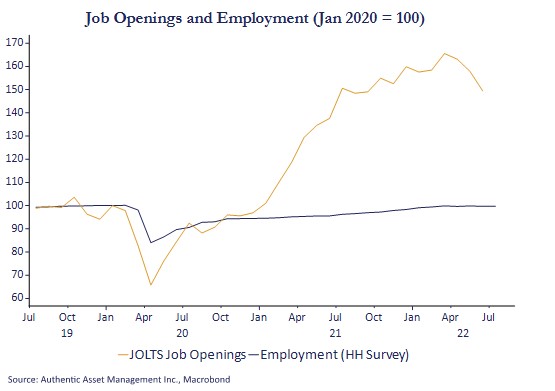

The July jobs data will make Fed efforts to jawbone rates expectations higher that much easier. The good news is that the economy is slowing as is the job market even if the report today would seem to suggest otherwise. After all, claims are significantly higher (more consistent with job growth around 200k), job openings data (JOLTS seen in the chart) are rolling over, and GDP has been weak to name just a few examples.

The market had latched on to the weaker data in the hope that the Fed would pivot. It is why the market has been pricing in a series of rate cuts next year but that has been wishful thinking given inflation next year around 4%, unless of course a serious downturn developed which the equity market is not pricing in.

I look at the report today less from labor market tightness (it is weakening) and more from the perspective of inflation. On this I would make two quick points. First, the strong hourly earnings reinforce a very strong Employment Cost Index print on the quarter which, if anything, is reinforcing fears that a wage price spiral could take shape. We don’t think it will. However, a recent BIS (the central bank of central banks) report highlighted a great deal of angst around the dangers if we do, the dangers of transitioning from a high inflation regime to a low one. Their point was that doing so is extremely painful.

That gives you some insight into the thinking of policy makers and where the risk/reward calculus now rests. The way to avoid this is to not get there in the first place. 5y5y forward inflation expectations (investor sentiment) shows it will be avoided. Consumer sentiment on inflation has not. That is the source of some fear among policymakers because that is what could drive the type of wage price spiral all central banks need to avoid.

The second point is that weak economic growth coupled with surging jobs means weak productivity. In a period of high compensation, it means a more inflationary bias to each unit of output in the economy. This is not just inflationary; it can also feed into consumer inflation expectations.

The incentive for the Fed and other central banks is to choke off inflation. They need to slow demand and make financial conditions tighter. Market pricing since June has done quite the opposite. Efforts to jawbone rate expectations higher will thus remain priority one at Jackson Hole. That may be good for the USD, but less so for gold, rates, and ultimately equities.

#AuthenticAsset #portfoliomanagement #investment