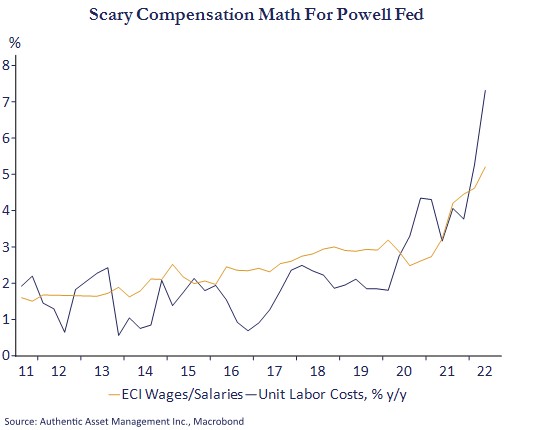

This chart is on my mind as the rebound in risk appetites continue to gather steam. Inflation did moderate in July, but there is no warmup for a victory lap at the Fed as the chart shows some disturbing compensation math closely followed by Powell. The Employment Cost Index (ECI) is one of the most definitive measures of wages and salaries and the last reading surged at a 6.5% annual rate and in y/y terms is rising at multi year highs.

That need not be a problem if productivity is strong. However, it is not, and the result is the combination of the two, reflected in unit labor costs (or the labor cost per unit of output) is at multi-decade highs.

The inflationary impulse from surging unit labor costs can be corrected by reducing wages and salaries by reducing labor demand which is what the Fed is aiming to achieve, and this affects growth to the detriment of equity values. Another alternative is for firms to absorb these costs through shrinking margins, also detrimental to equity values (in H1 2022 there was no evidence firms are doing so or are being forced to do so). Those costs can also be reduced by stronger output per unit of labor (productivity), but output looks to remain tepid and the labor market too strong relative to that output. That leaves more heavy lifting for the Fed which is also likely to be detrimental to equity values.

Fed fears of a secular transition from a low inflation regime (the past 40 years) to a high inflation regime are not grounded in supply chain disruptions or commodity prices. Those ebb and flow and in the case of the former ultimately self-correct. Their fear is based on a wage-price feedback loop into inflation that once started is difficult to change. In the context of the last jobs report, this chart reinforces the central point that much work remains.

Financial conditions, however, are getting looser, not tighter. Real interest rates are 55bps off their highs and equity markets anywhere from 15% to 20% off their lows. Meanwhile, the market is pricing in a series of rate cuts next year that leaves policy rates almost 60bps lower than what was expected 8 weeks ago. That may prove to be correct, or wrong, but in the meantime, it increases the tension between where the Fed wants to be and where the market is trying to lead it.

It is clear inflation is peaking and is rolling over, but the question is to what equilibrium once the supply side issues fade and demand side drivers, as shown in this chart, predominate. For the Fed, equilibrium is around 2.0%. Unless they turn the lines on this chart considerably lower that will be wishful thinking and it is why expectations of a Fed pivot are premature. It also suggests the exuberance driving risk assets also feels premature.

#AuthenticAsset #portfoliomanagement #investment