Financial markets are driven by momentum and over the past year or so the momentum in inflation and its associated inflation fears reached levels not seen in decades. High inflation can be corrosive to growth and asset prices, and very high inflation as we have witnessed over the past year especially so. However, nothing moves in a straight line higher (or lower) and the good news is that the worst of inflation is now over.

The factors that pushed inflation higher are simply abating. Supply constraints remain high but are easing, wage inflation is high but leveling off, shipping costs are high but falling, and base effects will become increasingly generous owing to the inflation surge of the past year. Operating margins that had surged over the past year as firms passed through inflation to consumers is narrowing and will continue to do so given inventories that have risen sharply and import prices will benefit further (to the downside) owing to the strength in the USD. Energy and food prices will remain high and continue to exact an inflation tax on consumers (and governments). But here too the momentum will fade.

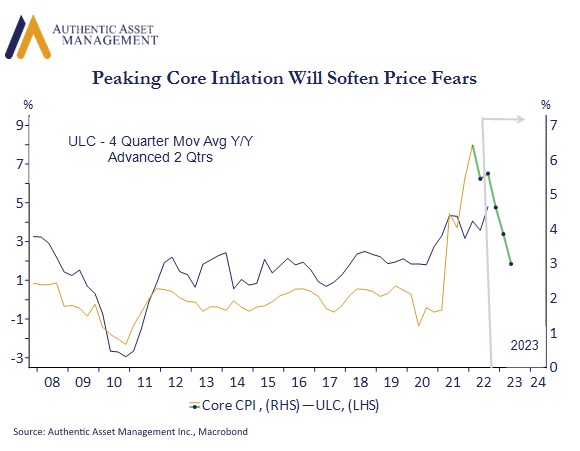

Inflation will move lower over the next 12 months and through next year led primarily by moderating core inflation. The Fed (and other central banks) will have more scope to balance growth objectives within what has been a frenetic drive to control prices. The bad news is that this moderation does mean price stability has been achieved. That will only be known in the fullness of time. As the dust settles, however, odds remain high that the inflation regime also settles into a range as much as 100bps higher than what we have been accustomed to since over past decades. For now, we take the good news where we can find it.

#AuthenticAsset#portfoliomanagement#investment

For more Insights by Authentic, please visit: https://authenticasset.com/insights/