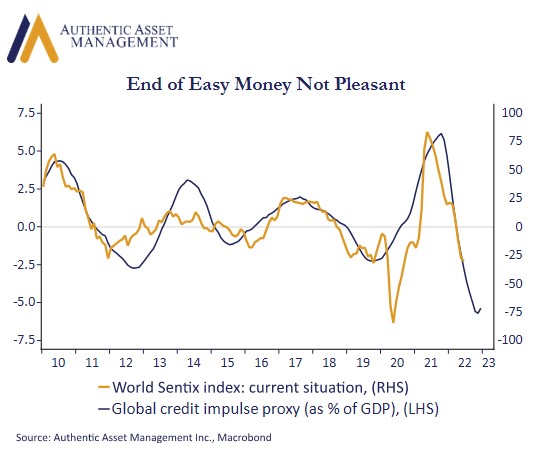

The sharp slide in the latest Michigan consumer sentiment survey may have been driven by record high gas prices, but it is not an isolated event. That measure of consumer sentiment hit a 40-year low. Sentiment across global economies is moving sharply lower. With the proportion of central banks raising rates against those lowering rates now at multi decade highs, quantitative tightening on track to drain liquidity further, and surging inflation operating as a tax hike, it is little wonder sentiment is low. It is also set to move lower.

This has implications for consumer behavior and buying plans and ultimately with a lag on capital investment and hiring intentions among firms. Weakening sentiment may or may not be the “canary in the coal mine.” But, it may be, and the lower it goes the higher will be the risks of a global recession.

#AuthenticAsset#portfoliomanagement#investment

For more Insights by Authentic, please visit: https://authenticasset.com/insights/