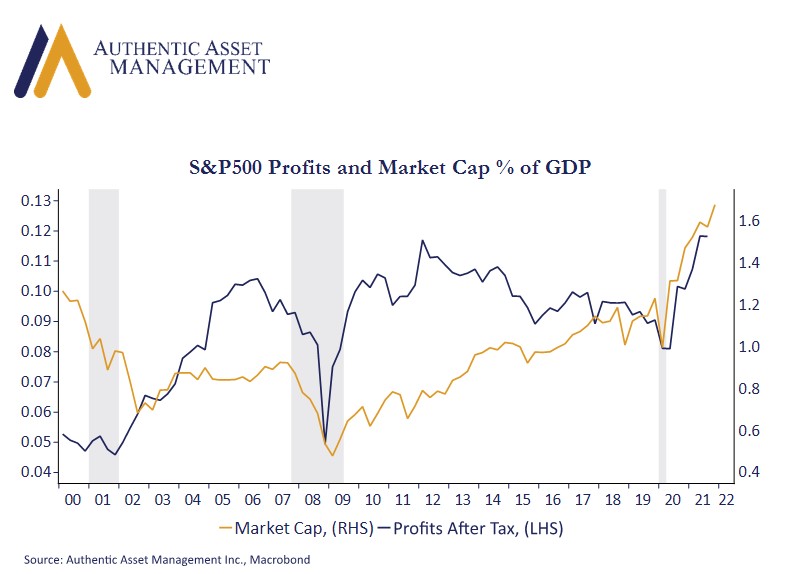

The equity market looks expensive and is expensive, but it is worth remembering that profit growth is also very robust. The market cap of the S&P 500 as a percent of the total economy has surged to new record highs of 160% as seen in the chart. That is above the peak of 130% during the dot.com bubble of the late 1990’s.

Relative to the size of the economy we also see the share of profits (after tax) also at a record high at approximately 14% using data through Q3 2021. Since 2000, that share has risen at a faster rate than market cap as a percent of the economy. That doesn’t mean that stock prices are cheap. After all, measures such as price/sales, price/book remain 2 standard deviations above the norm. It does, however, reinforce our view that where markets settle as we transition to tighter policy and higher inflation is driven more by what investors are willing to pay per unit of profit rather than a paucity of profit growth per se. That is where multiple compression becomes the key drive of fair value in equity markets.

#AuthenticAsset#portfoliomanagement#investment

For more Insights by Authentic, please visit: https://authenticasset.com/insights/