This year has been a difficult start for 60/40 equity/fixed portfolios. Equity markets and bond market returns are both down on the year and the weakness and volatility in risk assets normally offset to some degree by bond returns has not materialized. This correlated risk among these two assets is unusual and there have been only four years in which both have fallen in value. It is why the 60/40 portfolio allocation model has been so popular for so long.

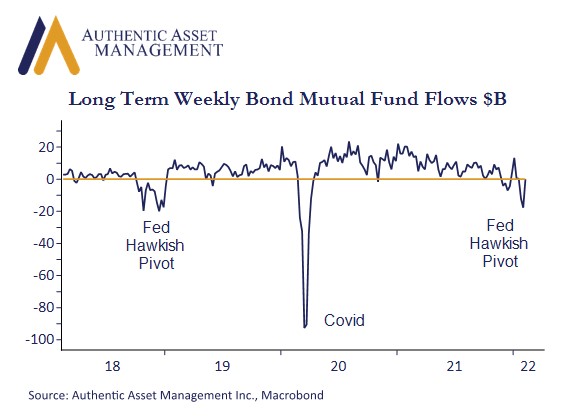

The chart included here showing weekly flows in long term bond mutual funds. Apart from the Covid shock in 2020, the last time these fund flows turned decisively negative was in 2018 when a hawkish pivot from the Fed spooked investors and led to extensive outflows which in turn helped push long term rates higher. It bears watching because these redemptions can cause a negative feedback loop where higher rates lead to higher redemptions which leads to forced selling and so on. Former Fed Chair Yellen addressed this risk in 2020.

Since 2018 bond mutual funds have been big buyers of Treasuries. They have absorbed almost 50% of the increase in net privately held debt since that time ($3 Trillion), exceeding foreign demand which absorbed another 43%. Today, recent outflows have been temporarily reversed by Ukraine related to haven buying. However, as geopolitical risks fade the risk of further redemptions could resume. That could magnify upward pressure on long term rates at a time when QE is coming to an end.

Market reaction to a Fed pivot in 2018 forced the Fed to reconsider their hawkish tilt. It is too early to know if a similar playbook is in store for 2022. Thus far bond fund outflows are not showing signs of gathering momentum. However, the risk is there, and the conditions today less accommodating for the Fed to turn more forgiving.

In 2018 inflation was running around 2.0% (at price stability) and today it is running 6% for core prices and even higher for headline (multitudes away from price stability). Moreover, real 10-year rates were over 100bps and today they have risen sharply but remain at -50bps. In this current inflation framework getting those real yields higher is a good outcome for what the Fed is trying to achieve. It would also help the Fed steer away from creating a flat or inverted yield curve.

The market is pricing a terminal policy rate of around 2.0% which is reasonable. Last week we indicated that it was a move that would not blow-up government balance sheets. An array of factors thus continues to coalesce around higher rates. Inflation, policy tightening, the end of QE, lower demand from mutual fund investors, and potentially a Ukraine invasion which could exert a longer lasting upward pressure on supply chain constraints, and commodity prices. In effect, bond returns are not well positioned to reverse course anytime soon.

#AuthenticAsset#portfoliomanagement#investment

For more Insights by Authentic, please visit: https://authenticasset.com/insights/