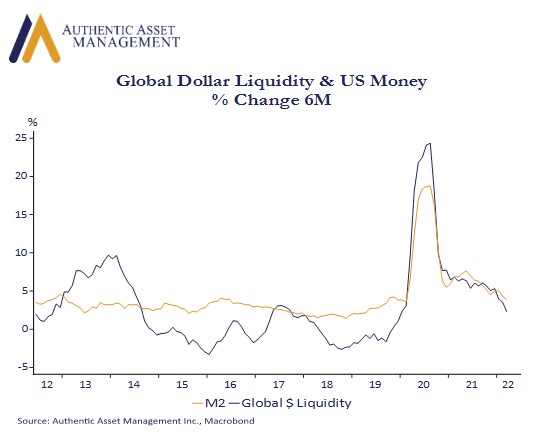

Global dollar liquidity surged in 2020 with the Fed’s $120B monthly bond buying program flushing the system with enormous sums of cash that facilitated the fastest post-recession gain in equities since WWII. All this liquidity needed to find a home and it did out the risk curve where investors remained giddy, paying a premium for earnings not seen since the dot.com bubble. The chart illustrates that the “delta” of this surge has been rolling over for some time in data ending in March, and significantly so. As central banks begin to shrink bloated balance sheets that weaker positive momentum will transition to outright declines in 2022. The April data will look worse than the March data and the May data worse than April, and so on and so on.

The other leg of financial repression (i.e. QE) that had pushed real borrowing costs lower has predictably reversed, with a vengeance. This coupled with a higher inflation premium has been a trifecta driving multiple compression. Investors are wisely paying less for each unit of profit growth. A year ago, that multiple was close to 23x earnings. Today it is closer to 17, a number that is now significantly closer to the long-term average of around 15. Further adjustment in this premium may well occur, but we are close to the bottom which is good for equity investors.

What is less good for equity investors is that the level of earnings and the pace of that earnings growth is yet to reflect what will surely be a more difficult economic environment as we get deeper into the year. In the post last week, we discussed this in terms of a “peak fear” in growth prospects that remains in its embryonic stage. A recession in 2022 is possible, especially in Europe, but unlikely in the US. That risk grows significantly next year, however. Odds are thus very good earnings will be revised lower and at a time when investors are already paying less for each unit of earnings growth. It is this looming risk that threatens to keep equity markets on the defense despite what is shaping up to be a likely near-term bounce from technically oversold conditions.

Dip buyers on market weakness was a hallmark of the recent run up in equities. Now the easy money is fading and more expensive money is here and dip buyers are conspicuously absent leaving risk assets to find a more sustainable equilibrium. This is what an adjustment looks like. It is healthy even if it feels painful.

#AuthenticAsset#portfoliomanagement#investment

For more Insights by Authentic, please visit: https://authenticasset.com/insights/