Quarterly Perspective Q3 2023 July 06, 2023

• Inflation continues to fall, peak policy rates are in view, and with shorts being squeezed and the fear of missing out (FOMO) back in vogue the bid for risk is on and volatility has collapsed.

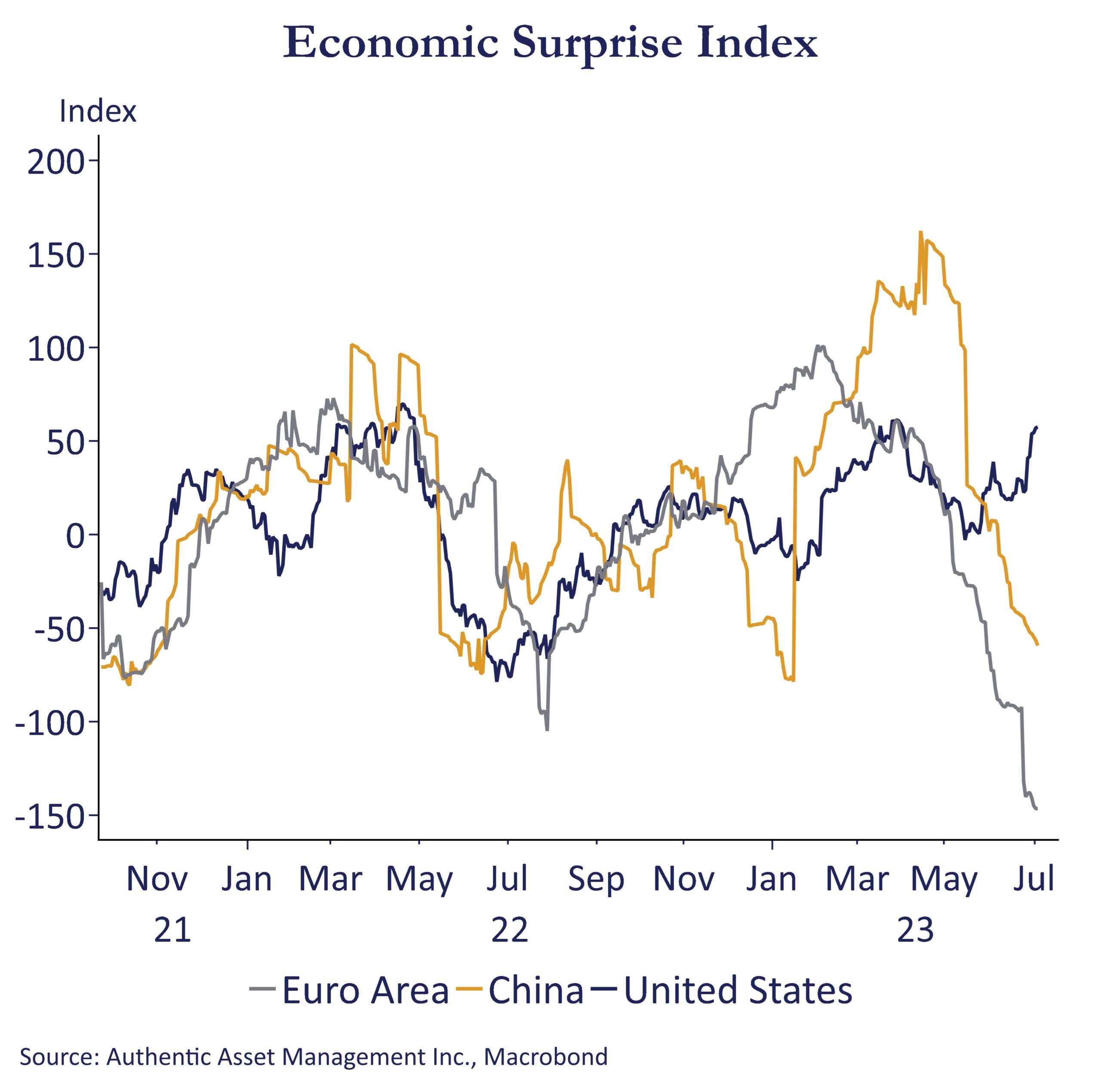

• We view the probability of a recession deferred as higher than the odds that a recession is avoided altogether. Weaker growth metrics are already here and we suspect economic data will surprise to the downside as has been the case in China and the Euro Area.

• We remain cautious in managing beta exposure. Volatility is low and hope for a soft landing is high, but recent strength in equity markets looks to be on thin ice.

A Glass Half Empty

Fear of recession has steadily diminished over recent months as expectations of a sharp slowdown in growth and corporate earnings have failed to materialize. Fears of an impending “credit crunch” in the aftermath of US banking problems with the collapse of SVB have diminished, and an unexpected boost in global liquidity from the BoJ and the increase in the Fed balance sheet after SVB, as well as a thematic grab for AI related firms have dominated market momentum. All these factors have helped take the sting out of aggressive central bank tightening regimes, at least for now. “Soft landing” is clearly the flavor du jour. Equities are on a tear. Inflation continues to fall, peak policy rates are in view, and with shorts being squeezed and the fear of missing out (FOMO) back in vogue the bid for risk is on and volatility has collapsed.

The obvious question is whether these themes will remain dominant. On that, our core views remain unchanged and we see headwinds to risk appetites that continue to persist. First, economic fundamentals are less robust than what is being reflected in the market. Second, inflation is falling as expected but market expectations for rate cuts remain exuberant in the absence of a slowdown in growth not yet factored into corporate earnings. Third, the drain on global liquidity has resumed and weaker economic fundamentals and stretched valuations are likely to lead to more volatility.

Economic Risks STILL On The Rise

Fears of an imminent recession have faded, and it is not hard to see why. The economy, both in the US and in Canada, has demonstrated real resilience. GDP in Q1 was stronger than expected in both countries, household spending has held up with labor market data remaining very strong. GDP forecasts have been revised upward relative to early 2023 expectations. In Canada that translates to 1.6% (up from 1.0%) and in the US to 1.5% (up from 0.8%) and while still lower from the prior year, the 2023 forecasts do not smack of any serious economic slowdown.

The global outlook does feel more uneven. Neither China nor the Euro area will be providing much momentum where economic surprise indices are sharply lower and growth prospects arguably weaker. According to the IMF, global growth is expected to be around 2.8% to 3.0% (down from 3.4% in 2022) and with an expectation of stronger growth in 2024. Taken together, it is not surprising that markets are inclined to view the growth equation as a glass half full, and the fallout from monetary tightening less severe than originally expected.

We view the probability of a recession deferred as higher than the odds that a recession is avoided altogether. First, we have never avoided recession when the weakness in the index of leading economic indicators and the inverted yield curve have been this extreme. It is worth noting that the lags typically associated with these signals to actual recession is anywhere from 12 to 24 months, so it is too early to declare victory relative to the historical record. Second, the effect of monetary tightening operates with long and variable lags. The economy has yet to reflect much of the tightening of the past year and special factors that have cushioned the effect of tightening, including large post-covid cash balances among others, are fading. Third, there is no clear catalyst to offset the eventual impact of policy tightening. It will come neither from China nor the Euro Area. And, it won’t come from consumption or fixed investment as the labor market weakens at a time when interest rates are high and the debt burden among households is around record highs.

Weaker growth metrics are already here and we suspect economic data will surprise to the downside as has been the case in China and Euro Area. (Chart) In the US, Gross Domestic Income (the accounting equivalent of GDP) has been negative for the past two quarters. This discrepancy will eventually be reconciled and likely done at the expense of GDP. Job growth numbers have been impressive. However, leading indicators of jobs reflected in hiring intentions and the length of the workweek are back to pre-covid levels, and firms reporting jobs hard to fill has fallen to multi year lows. The magnitude of these moves has always preceded a sharp slowdown in hiring and in the case of four consecutive monthly declines in the index of hours worked, always precedes a recession. The much-feared credit crunch from the community banking crisis of Q1 has not materialized. However, ongoing caution here is warranted. Moreover, the significant tightening of lending standards that preceded SVB persists, and they have tightened at a pace that in the past has always led into a recession.

The consensus view in mid-2008 was that a soft landing was the likely outcome. The consensus view of a soft landing today may well prove correct. However, risks to growth are ignored at one’s peril. As we fast forward to 2023, we differ from the market in that we see growth prospects as a glass half empty, not half full, and potentially worse.

Central Bank Reversal -Needs Weaker Growth

Policy tightening among global central banks has come a long way. China is unique in its efforts to lower rates to stimulate growth. The BoE, the BoC, the ECB, and the Fed will continue to remain hawkish even if there are small differences in how far each will proceed from here. The BoC is done. The Fed pause may prove short-lived as one more rate hike is likely, but we suspect that will be the last of the cycle even if the consensus view at the FOMC is for two more rate hikes.

Fear of a hard landing has receded relative to expectations earlier in the year, but the ultimate profile of expected monetary easing has not. This feels like wishful thinking. Inflation is falling. However, the pace of inflation remains well outside the 2% definition of price stability and may well prove sticky around 3%. If so, the type of aggressive response anticipated by the market is unlikely. As of mid-2023, equity markets are priced for a soft landing and rate cuts, an inconsistency yet to be resolved.

Market Positioning

We remain defensive in managing beta exposure. Volatility is low and hope for a soft landing is high, but recent strength in equity markets looks to be on thin ground. Bull markets do not start at the trough of unemployment, with little breadth, not with multiples consistent with the Covid and Tech bubbles, not when we have high debt levels, low productivity, and when recession risks are this high. Profit margins are falling, and revenues and earnings are likely to follow.