Quarterly Perspective Q4 2023 October 04, 2023

• We remain skeptical of a “soft landing” scenario and expect downward revisions to 2024 corporate earnings and with high real interest rates likely to persist for longer we see more downside for risk assets over coming months.

• Recession risks are mounting at a time when we are at or close to peak interest rates. A hoped-for equity rally driven by a series of rate cuts in 2024 is fading as market moving closer to our view and that of more hawkish central banks.

• Recent pressure on equity markets is likely to persist. Now is a time to be cautious and mindful of building risk, not a “fear of missing out.”

No Fear of Missing Out

Our mantra over the past several Perspectives has been one of caution. That has not changed. It has been predicated on our skepticism of a “soft landing” scenario and a belief that the lagged impact of tight monetary policy, an inverted yield curve and 17 monthly declines in the index of leading economic indicators all pointed to a significant economic slowdown in the US (and elsewhere), if not a recession. That view ran counter to the prevailing view among many pundits, and equities for much of 2023. Soft landing proponents have had the upper hand as growth in the US and Canada clearly surprised to the upside relative to early 2023 expectations and even as this goes to print the Atlanta Fed GDP Now estimate for US growth in Q3 approaches a whopping 5%. Some suggest we have nailed the soft landing.

Through much of the time since October 2022 to August 2023 equities was driven by a benign technical picture, momentum, sentiment, and the fear of missing out on the type of rally that in the past kicked in as we approached peak policy rates. Ultimately, however, the market follows economic fundamentals. Lingering within this bullish narrative was a fundamental picture that was poised to become more problematic, perhaps significantly so. Over coming months, it is this less supportive economic backdrop that will be the primary driver of risk assets. That weaker growth will keep the disinflationary trend now in place intact. However, hope of a rescue from central banks remains more uncertain relative to past cycles, and downward revisions to 2024 corporate earnings, and high real interest rates are likely to breed a level of volatility largely absent over much of 2023.

Fundamentals Turning Less Favorable

Special factors that have kept growth and earnings expectations stronger than they otherwise would have been are fading. One primary factor has been fiscal stimulus which has been working at cross purposes to the Fed. That fiscal impulse, something we can measure by the change in the flow of money, is now turning neutral and in 2024 will be negative. Another factor has been the residual buildup of Covid surpluses among households, but with savings rates now below pre-Covid levels that too will become a headwind. Finally, strong labor markets have been hugely growth positive. However, there are signs this too will weaken, as it always does when the aggregate factors supporting demand falter.

The impact from fading fiscal support and the rundown of household surpluses will be exposed by an economy dealing with high interest rates and in search of a new growth engine. Purchasing manager surveys, usually a good leading indicator of growth has been in contraction territory for 11 months. Money supply (M2) has collapsed at the fastest rate on record, the reprieve in student loan payments (recall this pile of debt is larger than all credit card debt combined) has now ended, and with job growth poised to slow we suspect economic warts are going to become more obvious. Against this backdrop is a fresh cycle high in borrowing costs (both real and nominal), rising energy costs, and a tightening in lending standards that in the past has always preceded a recession.

The view that this time is different may well prove correct. However, where is the source of growth going to come from? Global growth prospects remain tepid with Germany approaching recession and the hoped for rebound in China proving ephemeral. Moreover, relief from central banks is not in the offing anytime soon. Quantitative Tightening will persist at a time when central banks have, for the first time since the early 1980’s, raised policy rates above the peak in the preceding cycle. The effect will be to create more challenging liquidity conditions, less lending and less borrowing, and higher debt service costs. Growth prospects will ultimately hinge on labor force growth and productivity. However, the recent trend in productivity is not encouraging and recent good news on the labor force butts up against a secular decline and added headwinds should labor demand slow. In the case of Canada, the labor force is growing at the fastest pace in decades (think immigration), but GDP per capita is falling, and despite a robust start to the year the risk is that a recession is already slowly taking root there. Gross Domestic Income (GDI) has fallen four straight quarters, momentum in Q3 is decidedly negative, housing has taken it on the chin and consumer spending is down sharply over the past several months. This is not economic Armageddon. It does suggest, however, that economic growth and earnings are likely to be lower than expected and interest rates higher than expected just a few weeks ago.

Elevated Rates for Longer

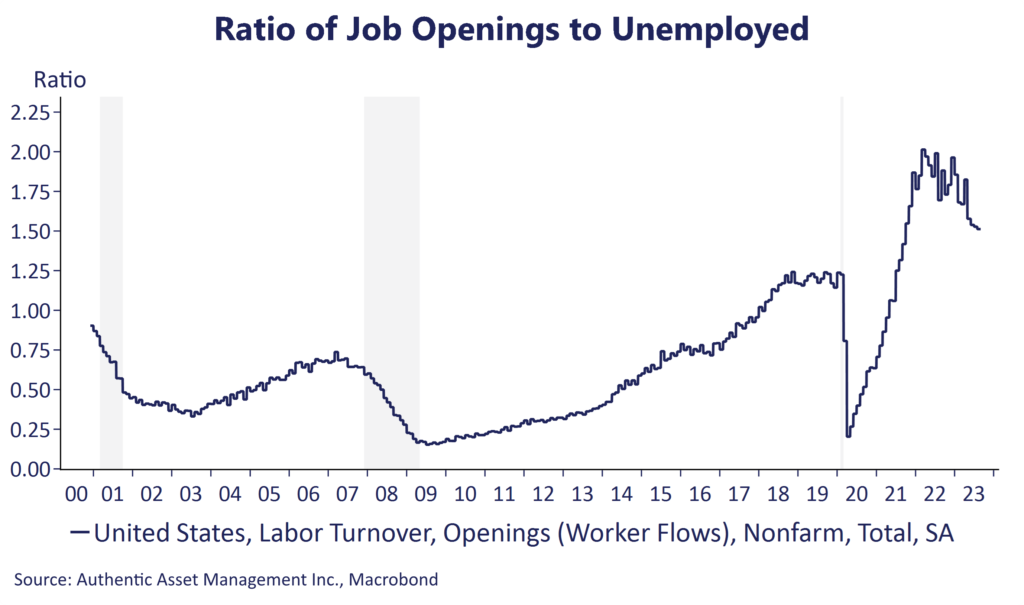

A reasonable question is why the Fed (and the BoC) both remain so hawkish? Chatter remains on more rate hikes and in leaning against any expectation of rate cuts over the next twelve months. On the one hand this is normal operating procedure for all central banks as they top off the rate cycle. More fundamentally, however, it is the latent strength in the economy over 2023 and inflation that is falling but remains high. With a 2% inflation target firmly entrenched central banks see more heavy lifting. Nowhere is that more evident than in the labor market. It is still tight as evidenced by the ratio of job vacancies to unemployed people, a ratio that stands close to record highs. (Chart 1) It is emblematic of a job market that has remained remarkably robust and it is this excess job demand that must be worked off before fear that the putative risk to inflation from a step higher in wage inflation will recede.

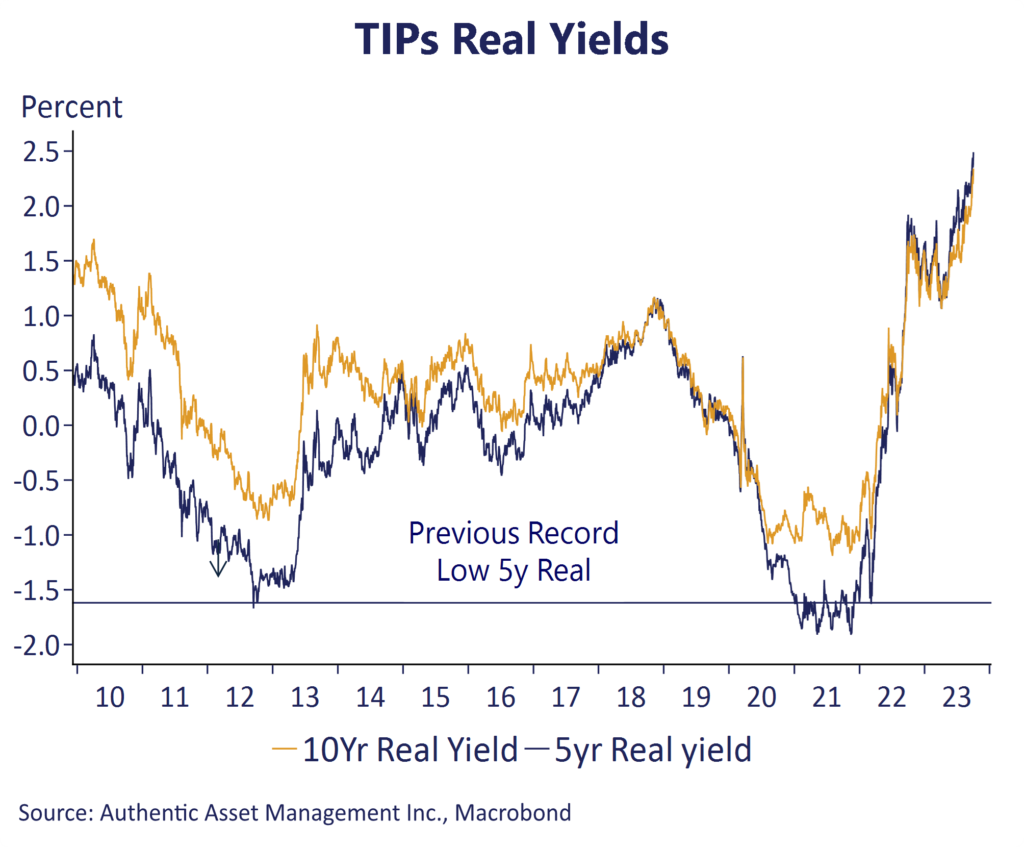

At the same time the rise in the global benchmark US 10-year yield offers a word of caution. Real and nominal rates are hitting multi-decade highs, but it less a verdict of optimism than it is on the surging borrowing needs of the US Treasury. (Chart 2) The recent move has not been driven by rising growth prospects and inflation concerns. It has been driven by rising term premia which is a fancy way of saying buyers need more compensation to fund a debt market where the three largest buyers, the Fed, foreigners, and corporations, are no longer buying at the pace needed to fund deficits. Those fiscal deficits are expected to improve in 2024. However, there is also the risk of a significant increase should the economy fall into a deep recession, and with another credit downgrade of US debt a looming possibility, and trillion-dollar debt servicing costs, that rising term premia is not likely to recede anytime soon.

Market Outlook

In our last Perspective we suggested that the next six months will be more volatile in part to the pernicious and lagged effect of higher rates. That lagged effect is now being married to another increase in market borrowing costs and a sensible realization that policy rates are not going lower anytime soon. Rising rates and weaker growth prospects are now undermining the bullish narrative in risk assets. Profit margins have been falling and will continue to do so, and as firms need to refinance some existing debt in 2024 odds are good that corporate balance sheets will weaken, especially among small cap stocks.

For the equity market as a whole, the two key questions are what this does to earnings expectations and what is the right multiple for those earnings. In the case of the former we suspect 2024 earnings estimates on the S&P 500 at $240 are too optimistic and something closer to $225 more reasonable. In the case of multiples, a combination of higher interest rates and an economic backdrop lacking any obvious near-term growth catalyst points to a convergence lower toward an historical average around 16. It means the recent pressure on equity markets is likely to persist. Now is a time to be cautious and mindful of building risk, not a fear of missing out.

Eric Green