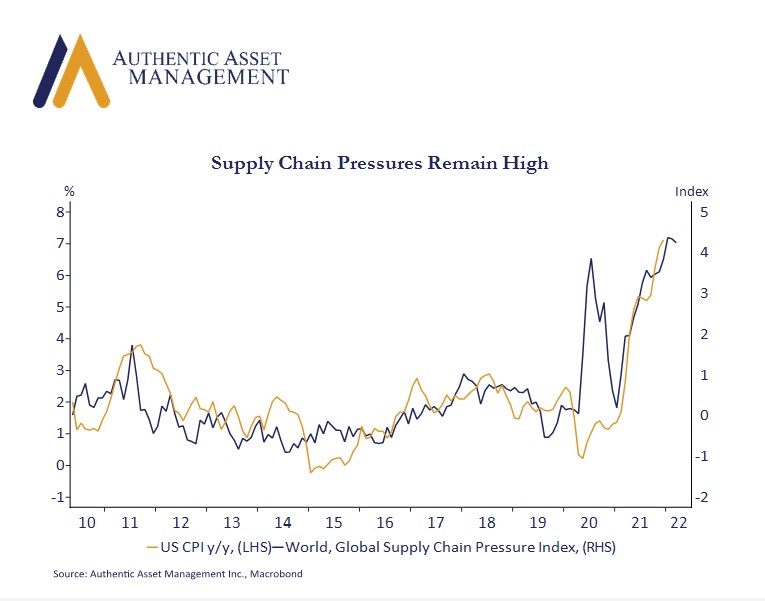

Global supply chain pressures remain around record highs and while other measures of disruption have shown modest signs of abating, these pressures feel more persistent than most had expected several months ago. It also stands in stark contrast to the initial shock from Covid in 2020 which otherwise eased in short order as seen in the attached chart. Today, this continues to show up across a host of goods markets including autos where used car prices remain at record highs at the end of 2021, and new car inventories around record lows.

Paradoxically, however, the main drivers of inflation will not be goods despite the supply chain pressures noted in the chart. The next leg of inflation will be in services. Service inflation has always been the main engine of inflationary pressures, at least over the past 40 years, and it has lots of room to run as service consumption surges back toward its pre-pandemic trend.

Ongoing supply constraints mean that good prices will not dampen aggregate price pressures. High goods prices had been expected to ease following an anticipated drop in world supply chain pressures. The Fed had hoped this could provide some breathing room in its expectation that goods prices would provide some offset to rising services inflation, but that is not materializing as hoped. It is a result that leaves the Fed vulnerable. That vulnerability is magnified by a policy mismatch between the current level of stimulus (QE, record low real fed funds) and inflation risks (40yr highs). Market expectations for more aggressive rate hikes by the Fed (and other central banks) is now the dominant theme in the new year, and appropriately so in our opinion.

#AuthenticAsset#portfoliomanagement#investment

For more Insights by Authentic, please visit: https://authenticasset.com/insights/