Repeated attempts to anticipate a so called Fed pivot has fed sharp bear market rallies within what has been a terrible year for equities and 60/40 portfolio investing. These moves have often by sharp and extreme reflecting a combination of hope and poor liquidity conditions as quantitative tightening takes hold seen in global dollar liquidity which is declining at 4.5% AR over the past six months. At some point the market will get it right, but at what cost?

The narrative today is that earnings expectations for 2023 are holding up well. The hope is that will remain the case. This is a dangerous orientation. Fed policy tightening has occurred at the fastest pace in 20 years and when you toss in the surging USD and QT (quantitative tightening), it is at the fastest pace in 40 years. Growth has weakened but is holding up owing in some measure to household cash balances that ballooned during the pandemic that have offset a chunk of this tightening. However, those reserves are being drained, and since all this tightening operates with a long lag on economic activity caution is warranted on growth prospects next year.

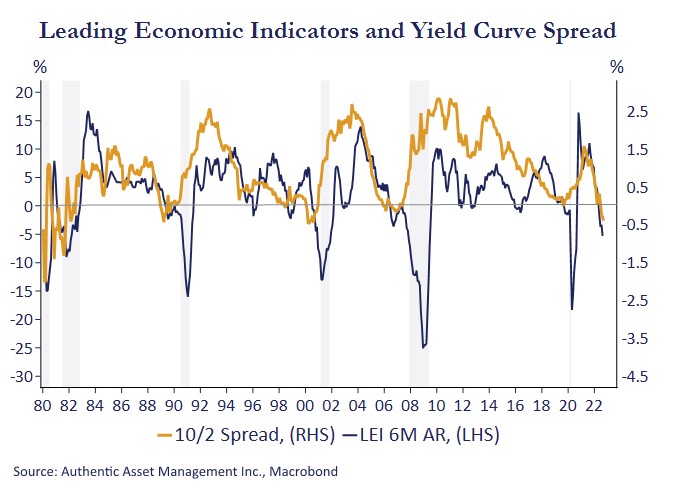

Over the past six months the index of leading economic indicators has fallen sharply, and as seen in the chart moves such as these have always preceded the onset of a recession. A similar signal is seen in the inversion of the yield curve. That doesn’t mean a recession looms. It does mean the odds are significantly high and getting higher.

The market has another 150bp points of tightening priced in bringing the policy rate to 4.5% or higher. Judging by 5y5y forward inflation expectations (2.3%) it would imply the Fed is not just moving to neutral (0.5% to 1% real rates) but is on the path to becoming highly restrictive (north of 2.5%). In effect, the new policy regime has switched from historic levels of accommodation to the tightest policy regime in 30 years– all within 1 year. Since the lagged impact on economic activity is still an unknown, it is hard not to see the risks within consensus expectations that corporate earnings will rise 12% in 2023.

The good news is that if there is a recession it is likely to be a shallow one. Household and corporate balance sheets are still in good shape. Household wealth is near record highs, and core household spending on food, energy, and debt service while up is still well below its long-term average.

The bad news is that even shallow recessions carry downward revisions to earnings and multiples. Even a 5% y/y increase in 2023 earnings would, with multiples falling a notch to 15, suggest fair value in the 3300 to 3400 range on the S&P 500.

So, the market will eventually be right in anticipation of a pivot by the Fed. The question is at what cost? It is why we favor remaining defensive in how we manage beta risk through these bear market rallies.

#AuthenticAsset #portfoliomanagement #investment