Do We Need A Recession? Getting to Price Stability

Fed Chair Powell affirmed in his Congressional testimony that the inflation objective of the Fed, and central banks the world over, remains the 2% sweet spot. That has me thinking on the eve of another strong labor report and an important CPI print next week.

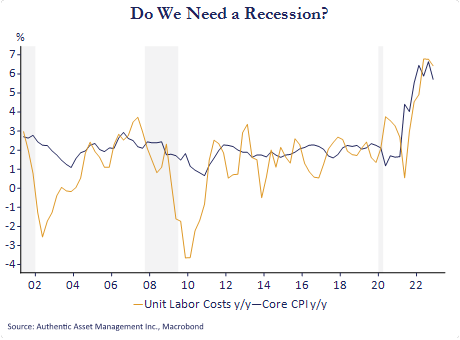

The chart shows the y/y change in unit labor costs and core CPI for the US. The unit labor cost data, while it feels a bit esoteric, is significant because it measures how much output you are creating per unit cost of labor. This is perhaps the most important single determinant of core inflation over time. Higher wages need not be inflationary if your output is high relative to the cost of that input, but the reality is quite different today. Productivity is low and the demand for labor is higher and higher wages are feeding into record high unit labor costs. That increases risk that wage inflation is passed through into final prices and that is exactly what is taking shape today.

High productivity could resolve this tension, but productivity is weak and will remain so. Also, judging by the latest JOLTS data, the demand for workers continues to significantly outstrip the supply which we know from Eco 101 is inflationary.

Those looking for a soft landing may be right, but it is more of a hope based on receding inflation risks than a reality based on achieving price stability over time. The factors that pushed inflation higher are indeed abating. Supply constraints remain high but are easing, wage inflation is high but leveling off, shipping costs are high but falling, and base effects will become increasingly generous owing to the inflation surge of the past year. Operating margins that had surged over the past year as firms passed through inflation to consumers is receding and will continue to do so.

However, it is hard to see the Fed achieving meaningful price stability with unit labor costs at record highs. It makes you wonder if ultimately the Fed needs a recession. During recessions unit labor costs fall sharply (see chart where gray lines are recession bars) and this may be the disinflationary impulse the Fed may ultimately need to use.

#AuthenticAsset #portfoliomanagement #investment