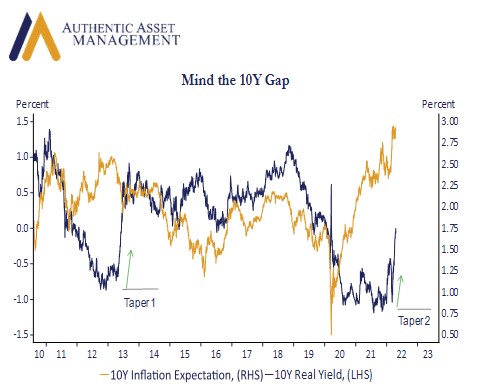

The end of financial repression can have swift consequences that are now unfolding in a way outlined in a previous post several months ago. That financial repression, which we are here defining as QE bond buying that pressed real yields to levels well below potential GDP growth (around 2.0%), is coming to an end and with Quantitative Tightening reversing it outright.

The spike in real US 10Y yields in the chart shows that adjustment materializing after a false start earlier in the year. What is unusual in this iteration of tapering is not the spike in real rates, but the persistence of a high inflation premium reflected in 10Y break even inflation expectations. Tighter financial conditions would be expected to push those expectations lower. That is yet to happen in the current period and is the primary reason the rise in nominal yields has been so persistent, and decisive. It reflects the uniqueness of the current inflation challenge. One that the Fed is now struggling to control through a better alignment of supply and demand through the growth channel.

The good news is that we are likely at peak pricing for inflation risk. Part of this is simply base effects which turn more favorable the deeper we get into 2022, and part is a presumption that supply chains will loosen and commodity prices will not surge further. The implication is that a continued rise in real yields will be offset in some measure by falling inflation risk. That is good news, but that is yet to materialize. If it does as we expect it will, then it is fair to presume the recent run higher in nominal yields may also be close to peaking.

#AuthenticAsset#portfoliomanagement#investment

For more Insights by Authentic, please visit: https://authenticasset.com/insights/