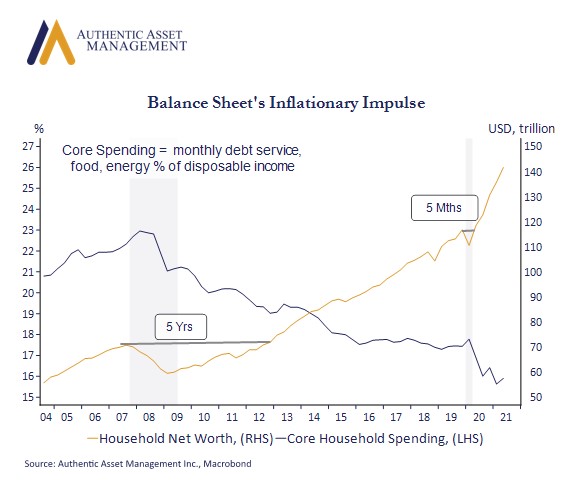

The attached chart supports the view that demand will remain strong despite surging energy prices and that business pricing power will also remain firm for the foreseeable future. That bodes well for operating leverage despite rising input costs from both labor and goods owing to well documented supply chain issues and higher commodity prices.

The rationale is straightforward, and it makes one wonder why the Fed is dragging their feet relative to other central banks in seeing the inflation writing on the wall. The chart shows US households are simply more resilient than ever before. The percentage of disposable income dedicated to core spending defined here as spending on debt service, food, and energy is holding around record lows. At the same time, household wealth has surged. In the US it stands at a whopping $140Trillion. In the 2008 financial crisis it took five years for household wealth to recover to pre-recession levels. In the Covid recession it took 5 months! In effect, business can pass along higher prices and get away with it because households are extraordinarily flush.

Prior to Covid every recession dating back to 1970 was preceded by a spike in energy prices which acted as a constraint on household balance sheets and was ultimately a deflationary event, not an inflationary one. Today feels very different. Inflation still doesn’t feel good, but it is not having the same type of demand destruction we have seen in past cycles, at least not yet. It means that higher commodities are not inhibiting demand (which is disinflationary), it is being passed through to consumers (which is inflationary) and that will continue to occur until it can’t. That happens when households can no longer absorb higher prices. With core spending as a percent of disposable income 25% lower and net worth 130% higher (or $81 Trillion) than it was at the start of this expansion one can presume that time is not now.

There remains a lot of dry powder among households which bodes well for economic growth and, by extension, corporate earnings into 2022. It also means that in the context of all the other well understood factors pushing inflation higher, this perspective heightens anxiety that the Fed is in danger of falling behind the inflation curve. When that happens, we all know how that usually ends. Not well.

#portfoliomanagement #investing #inflation #economy

For more Insights by Authentic, please visit: https://authenticasset.com/insights/