The velocity of money gives us a useful way to view inflation risks that have thus far been largely dispersed across sectors suffering supply shocks stemming from post pandemic economic re-openings. The tapering announcement by the FOMC yesterday included a statement by Powell that inflation risks are likely to be transitory. However, if supply chain disruptions are persistent the Fed will use its tool to keep inflation at bay. That is a shot across the bow, but a concern that plays out only in the fullness of time. However, there is more to the inflation playbook than just one play.

This is where the velocity of money may be useful. The quantity of money theory posits a direct relationship between money supply times velocity must equal the general price level of the economy times the quantity of output produced. Velocity is the component that measures the turnover of money in the economy and is a residual in the above relationship. If velocity were constant, for example, an economy where money supply is growing by 15% and the output is 10% then inflation must be 5%. In principle, the higher the velocity the higher is the putative inflation risk for any given level of money. That is a simplification of course and Keynesians are right to argue that it is a very unstable and volatile measure.

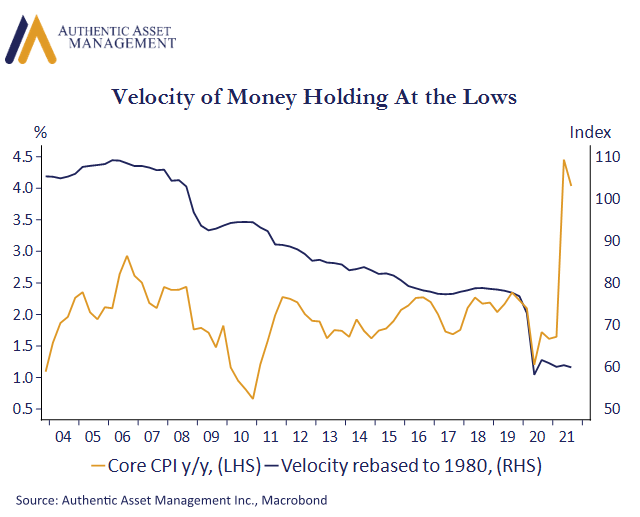

Nevertheless, it can provide clues that shape inflation risks going forward. Fiscal stimulus and QE created a surge in the growth of the money supply. Velocity collapsed during Covid as the amount of growth generated per unit of money declined as households and business accumulated savings and did not spend. In effect, there was no one-for-one proportional increase in nominal GDP as it took more money to generate a given level of output owing to this low turnover of money. This, in turn, added to the pool of liquidity and helped fuel a boom in asset prices.

What happens if that behavior shifts? That money is still out there and will continue to grow as the Fed tapers even if the pace of that growth will diminish. If growth per unit of money begins to increase that is good for economic growth but it may also be very inflationary. This risk is magnified by current supply chain disruptions and a service sector that also suffered attrition in supply capacity during the pandemic.

If the velocity of measure revisits its pre-pandemic levels the Fed has another significant wrinkle in inflation risks, one arguably more enduring and pernicious than the supply chain disruptions getting all the attention. We are not forecasting a jump in velocity. We are, however, mindful to the risks such a move would pose for the Fed, inflation, and the current path of interest rates.

#AuthenticAsset #interestrates #economy #portfoliomanagement

For more Insights by Authentic, please visit: https://authenticasset.com/insights/