• Equity markets have begun to feel the weight of an historic run-up in prices. The transition to a post “peak everything” regime makes for a more challenging environment for fixed income and equities.

• The global economic recovery is on solid ground. However, as growth expectations are scaled back amid high inflation we hear rising concern of stagflation, a fear we consider premature.

• We expect the Fed to taper bond purchases at the November FOMC meeting. That will lead to tighter financial conditions, create a drawdown on global dollar liquidity, and push interest rates higher. We have turned more cautious and suspect better entry levels into equities may yet be had over the near term.

The Other Side of Peak Everything

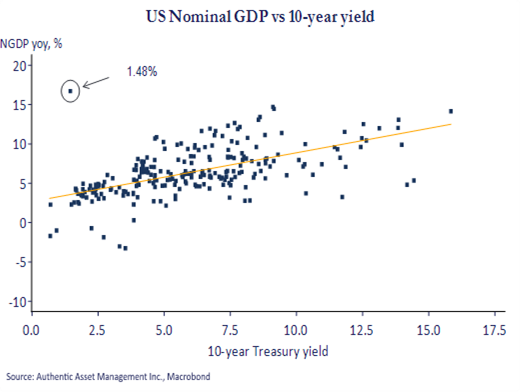

Global dollar liquidity surged in 2020 with the Fed’s $120B monthly bond buying program flushing the system with enormous amounts of liquidity. That facilitated the fastest post-recession gain in equities since WWII. It also kept bond yields low. We can see this in the accompanying chart plotting the relationship between yields and year on year changes to nominal GDP on quarterly basis dating back 50 years. Higher growth typically results in higher yields as represented by the upward sloping yellow regression line, but central bank policy has interfered in that adjustment. Such is the power of quantitative easing. These lower yields have helped push the premium investors pay for each unit of profit growth higher, and higher.

Equity markets have now begun to feel the weight of that historic run-up. Global markets must digest what has been a latent awareness that we are now transitioning to another environment, a post “peak everything” regime that feels more uncertain. Economic growth momentum has peaked, earnings momentum has peaked, the impulse from vast Covid fiscal measures is waning, and liquidity injections from central banks are all losing momentum. As the Fed begins to “taper” its bond purchases interest rates are also likely to move higher. All these factors create a more challenging environment for most fixed income and equity assets.

Economic growth has been robust and a slowdown relative to what has been hyper post covid growth rates was expected. Those growth expectations will be trimmed further as world economic surprise indices have drifted into negative territory in the US, Europe, Japan, and China. None of this is to suggest that a recession is imminent. Far from it. The fundamentals supporting continued growth are excellent, but it is also reverting to something closer to trend. This growing appreciation for “peak everything” at a time when global inflation and consumer expectations for inflation remain at a multi-decade high breeds added uncertainty. It also breeds rising concern of stagflation. That is, a period of high inflation and low growth the mix of which is toxic for equities.

We believe the fear of stagflation is premature. First, it is probable that much of the recent rise in core inflation has been driven by supply dislocations from the pandemic. As these constraints ease odds are good the next move for inflation is considerably lower in year-on-year terms. Moreover, core inflation will ultimately be driven by the pace of unit labor costs (labor efficiency), and over the near term these too are rolling over. That is not to say inflation is not an issue. We do suspect the inflation regime has permanently shifted about 50bps higher owing primarily to deglobalization, the rollover in the growth of cheap labor, and in the re-shoring of supply chains that have contributed to a spike in input costs. If we are right this structural uptick in inflation is a change in degree, not of kind. That may ultimately prove too conservative. However, at this point there is no reason to presume it is, and if so it is not stagflation writ large.

Second, economic growth prospects may be normalizing off post-covid highs, but they remain strong given stellar household balance sheets, pent up savings, and a massive pent-up demand for business investment that will contribute to growth. That in turn will contribute to stronger productivity that should constrain the growth in unit labor costs (and inflation) over the medium term. We do believe changing demographics, rising interest rates, higher inflation, and uncertainty on the durability of stronger productivity are long term impediments to growth. However, this is not emblematic of stagflation in the conventional sense. We will learn more in the fullness of time, but there are other more pressing matters to consider.

Interest Rates

We expect the Fed to begin its long-awaited tapering process at the November FOMC meeting. When the central bank is buying $120B in securities a month a reduction to $105B or $110B may not appear to be significant. It is, however, a critical first step to tighter financial conditions. Fed Chair Powell suggests the full “taper” can be completed by mid-2022 the effect of which will create a drawdown in global dollar liquidity. It means significantly tighter financial conditions compared to where we have been.

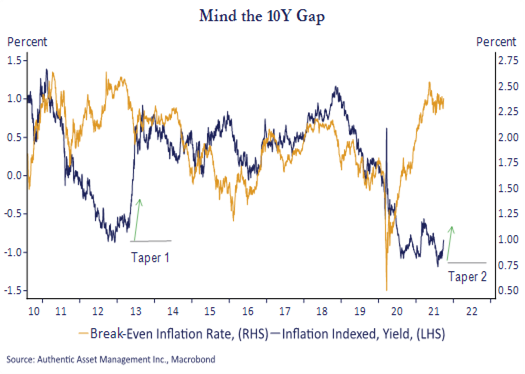

Less accommodative financial conditions would be magnified by higher yields. We can animate the potential for higher yields in the chart above. It depicts a likely adjustment in the gap between US10Y real yields and a US10Y inflation premium. In the 2013 taper that gap closed with a recalibration in real yields. We expect something similar over coming months. Higher real yields normally suggest stronger growth prospects, but in this adjustment, it represents a market uncoiling from the heavy hand of the Fed. While the move higher may not be as significant as 2013, the direction is clearly established.

Uncertainty to Persist Over Near Term

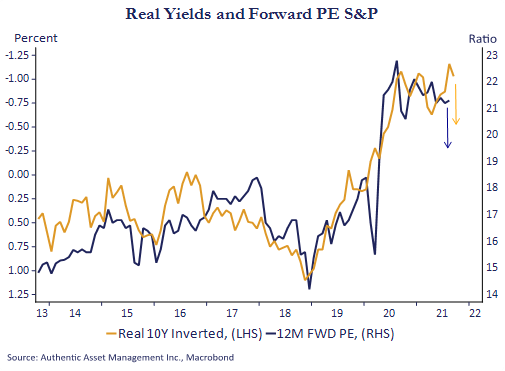

Perspectives on the path of future inflation and economic growth are colored by solid arguments on all sides the verdict of which will only be known over time. Over the near term it is the tightening in global dollar liquidity and the shift to tapering that has our attention. Its impact is more immediate. This can be seen in the last chart. Higher rates should compress the premium investors pay per unit of profit growth which, holding all else constant, is a headwind for equities. That headwind may be overcome by stronger profit growth. However, profit expectations are already high, and we know where the balance of risks get tilted if economic growth fails to meet expectations as it is now.

The global economic recovery is on a solid footing. However, risk appetites are now morphing into something likely to feel more balanced and more normal. It is not a bear market, but we expect more volatility over the near term and with it, better entry levels into equities. Withdrawal from the sugar high induced by pandemic policies that are no longer required is a healthy development, even if it may not feel as such.

For more articles by the author, please visit: www.authenticasset.com/perspectives/