Many investors have profited in a world of TINA (There Is No Alternative) where the appetite for risk assets such as equities has thrived as the returns from other investments such as fixed income has languished over a regime of low yielding alternatives. While clipping coupons off bond holdings is not all that bad, low yielding fixed income assets has left money managers with fixed liabilities struggling to generate sufficient returns. It is why many pension funds have increased allocations to equities, real estate, and private equity to boost returns.

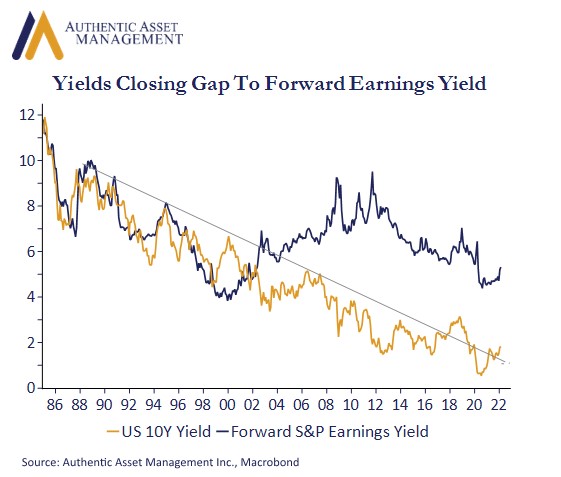

The chart shows the forward earnings yield of the S&P 500 against the yield on the US 10Y note. This relationship was a central feature of the old Fed equity model. The idea then was a simple one. It held that optimal portfolio allocation could be be guided by the presumption that equities are cheap on a relative basis when the earnings yield is above the 10Y, and expensive when it is below it. Such was the case was at the end of the dot.com bubble in 2000. However, the relationship lost any practical utility in the low inflation easy money years of the past two decades, a period in which rates fell and stayed at record lows.

This chart is not designed to demonstrate if equities are rich or cheap. At face value, they would appear to be a screaming buy. It does, however, give us a sense of the comparative return on investment and the conclusion for now is that the world of TINA persists. However, that advantage is slowly being eroded, and the comparative allure of equities may slowly diminish.

Monetary accommodation is still very easy, but it is about to get much tighter. Inflation is also sharply higher and while 5y5y forward inflation expectations remain well anchored, odds are rising that a significant regime change for inflation is afoot. It means that the long-term trend in disinflation is over, and with it the long-term trend in lower yields which are showing a convincing breakout above that trend. Toss in quantitative tightening by the Fed and budget deficits as a percent of GDP holding well above trend and the odds are good that the clearing price for debt will continue to move one way, higher. It would suggest the relative allure of equities is likely to diminish over time as the key driver in the optimization of portfolio allocation strategies.

#AuthenticAsset#portfoliomanagement#investment

For more Insights by Authentic, please visit: https://authenticasset.com/insights/