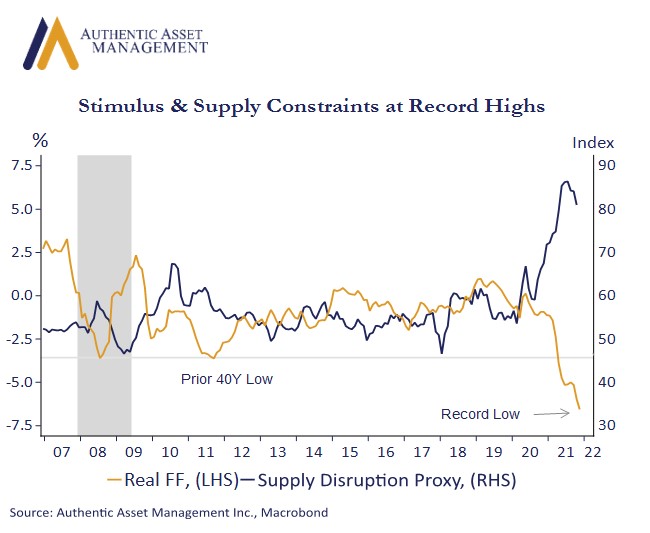

The sugar high of monetary stimulus has become ever sweeter as inflation has surged. Real Fed Funds rates have collapsed to a record low providing further stimulus to a robust economy already dealing with supply constraints. This is a policy stance that risks undermining their hard-won inflation credibility. For a central banker losing that credibility is like having someone rip out your soul, so tapering has been accelerated, and achieving the needed flexibility to raise rates is now more essential. That feels even more urgent after the latest batch of employment data has pushed the Fed within a whisper of their employment mandate.

First the good news. Base effects alone suggest prices in y/y terms will decelerate over the course 2022. This in turn will be supported by easing of supply constraints in goods (underway), and by a weak credit impulse in China that has been a good leading indicator of key commodity input prices. Real policy rates will naturally move higher. The other good news is that higher rates will not fundamental alter a solid economic outlook. Growth next year will remain well above potential GDP, household and corporate balance sheets are flush, and a pent-up demand for capital investment will gain more expression in the coming year.

Now the bad news. The risk that the Fed is behind the inflation curve and tightens more than expected. In the past this has always, and emphasis here on always, led to a bad economic outcome. Still quantifying that risk is difficult because forecasting inflation is difficult. Goods inflation may give way, but service inflation which is the bulk of the CPI has yet reared its ugly head. Powell admitted yesterday that service inflation and wage pressures have not yet been a factor, but he knows they will be, just not how much. Unlike goods consumption, service spending remains well below its pre pandemic trend. It should be noted that supply constraints are not confined to goods. The bounty of cheap global labor is diminished, and in the US labor shortages will persist pushing wage inflation higher. If inflation continues to surprise to the upside and show signs of persistence (a word that has already replaced “transitory”, then the policy balance will tilt decisively to fighting inflation at the expense supporting real growth. That is a trade-off that the Fed has thus far been able to ignore.

The extent to which strong short term growth trumps more challenging long term growth constraints and leads long term interest rates higher remains uncertain. What is more obvious, however, is that the great liquidity machine has run out of gas. While growth in 2022 will keep earnings on an upward path, the new year will also bring more uncertainty, and with it more volatility as risk appetites morph into something that feels more normal.

#AuthenticAsset#portfoliomanagement

For more Insights by Authentic, please visit: https://authenticasset.com/insights/