The shifting factors driving business pricing power concern policy makers and should keep investors wary of a Fed pivot anytime soon. A host of Fed speakers has reinforced the Powell rhetoric at Jackson Hole affirming a hawkish bent on inflation. The good news is that the markets are pricing in a chunk of rate hikes with a peak rate of around 4% in early 2023. The potential bad news is that a growing cohort of investors don’t believe the Fed can or will deliver, and if they do, one should expect the Fed to ease thereafter.

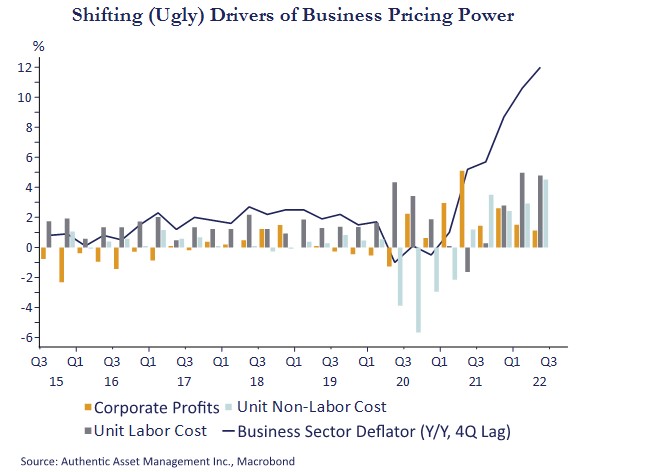

Which brings me to this chart and why the Fed is likely to deliver. There are lots of ways to dissect underlying inflation momentum, but in the context of surging labor compensation and what the Fed is trying to achieve this often-overlooked measure is illuminating. The chart shows the relative contribution inputs driving the Business Price Deflator. This is effectively a measure of business pricing power and is composed of several interrelated components that include unit labor costs per value added, unit profit growth per value added, and unit non-labor costs as a percent of unit value added.

Unlike 2021, the drivers in 2022 are not strong unit profits (yellow bars), but rather high unit labor (gray) and unit non-labor costs (light blue). So, why is that a problem?

If the Fed could suggest that inflation is transitory in 2021 as prices rose on strong growth and profits, they understood those drivers of inflation are more “transitory.” Firms price for profits when they can and reduce prices as inventories rise to preserve market share. Labor and non-labor cost inputs, however, are generally less transitory and is one reason Powell got off that messaging long ago and invoked ex Fed Chair Volker in his comments that winning this war could be painful.

The true driver of trend core inflation is unit labor costs because it measures the cost of labor in the context of how efficiently one produces stuff. You can pay more for labor, but if you produce more per unit of labor then the result is not inflationary. Unfortunately, productivity has been and is likely to remain weak and a failure now to reduce wages/compensation could create a negative feedback loop that threatens price stability.

Looking at the problem this way, we can see more clearly Fed thinking and paths to success. One is to have firms slash prices. However, this is not good for operating margins and likely insufficient given the small component of unit profits shown here. The other is to cut the demand for labor and reduce compensation costs. What is likely is some combination of the two.

Either way, the drivers of inflation suggest a more challenging environment for equities and higher volatility. They also suggest the risks that the Fed needs to do more than many expect this year and next remain very real.

#AuthenticAsset #portfoliomanagement #investment