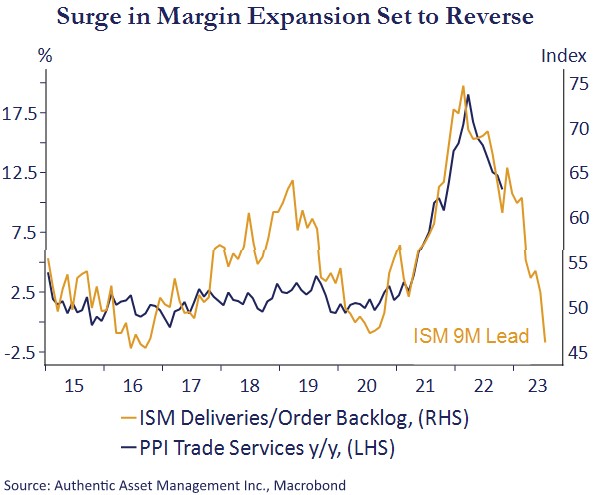

One of the hallmarks of the initial lurch higher in underlying inflation is now fading and fading fast. Supply side constraints after Covid pushed costs of most elements within the supply chain higher, all of which was reflected in a jump in delivery times and order backlogs which hit record highs. Covid pay outs, fiscal stimulus, and monetary accommodation that pushed asset prices higher padded consumer wallets which in turn enabled a significant expansion of firm’s operating margins. This fed indirectly into the consumer inflation prints.

That narrative is being reversed. One way of animating this is using the latest PPI trade data tracking prices for final demand in both services (in the chart) and for goods (not in the chart but a similar story). In the chart, the y/y changes are shown against a combination of the ISM delivery index (measure of bottlenecks) and order backlogs which is pushed forward by nine months. From this chart we can form several quick conclusions:

- First, supply side inflationary pressures are receding and are likely to recede significantly more over coming months.

- Second, demand pull inflationary pressures are now, and will continue to be, the predominate drivers of inflation which is good news for the Fed which can only affect inflation through the demand channel. Policy makers should love this chart.

- Third, if margin expansion flattered corporate profits on the upside, margin compression is likely to have the opposite effect over coming months. This in turn will be reinforced by a rundown of consumer cash balances and the Fed’s determination to raise unemployment and reduce wage growth.

Of course, this is an incomplete picture of inflation and service inflation will remain victimized by the lagged strength in rents and housing. Still, with the NAHB homebuilders index now at a fresh 10 year low and the Zillow rental index collapsing to pre covid levels it is only a matter of time before the lagged impact from this also fades.

Good news is not the whole news, however. Saying inflation is rolling over is hardly a heroic statement. The question is to what level and what is the new trend underlying inflation rate going forward? Knowing that gives you a leg up on if and how far the Fed can pivot in the face of mounting growth risks. Truth is nobody knows. Odds are good that it has shifted higher, however, from the prior range of 1% to 2% and towards something in the 2% to 3% range. What is more certain is margin compression and weaker economic growth will inevitably shape how corporate earnings perform in the coming quarters.

#AuthenticAsset #portfoliomanagement #investment