We expect the Fed to begin its long-awaited tapering process at the November FOMC meeting. When the central bank is buying $120B in securities a month a reduction to $105B or $110B may not appear to be significant. It is, however, a critical first step to tighter financial conditions. Fed Chair Powell suggests the full “taper” can be completed by mid-2022 the effect of which will create a drawdown in global dollar liquidity. It means significantly tighter financial conditions compared to where we have been.

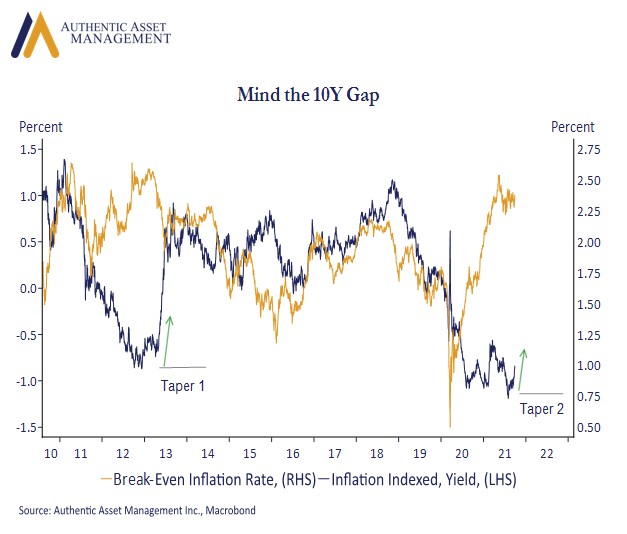

Less accommodative financial conditions would be magnified by higher yields. We can animate the potential for higher yields in the chart above. It depicts a likely adjustment in the gap between US10Y real yields and a US10Y inflation premium. In the 2013 taper that gap closed with a recalibration in real yields. We expect something similar over coming months. Higher real yields normally suggest stronger growth prospects, but in this adjustment, it represents a market uncoiling from the heavy hand of the Fed. While the move higher may not be as significant as 2013, the direction is clearly established.

The global economic recovery is on a solid footing. However, over the near term it is the tightening in global dollar liquidity and the shift to tapering that has our attention. Its impact is more immediate. Risk appetites are now morphing into something likely to feel more balanced and more normal. It is not a bear market, but we expect more volatility over the near term and with it better entry levels into equities. Withdrawal from the sugar high induced by pandemic policies that are no longer required is a healthy development, even if it may not feel as such.

#economy #interestrates #fedpolicy #portfoliomanagement #investingstrategy

For more Insights by Authentic, please visit: https://authenticasset.com/insights/