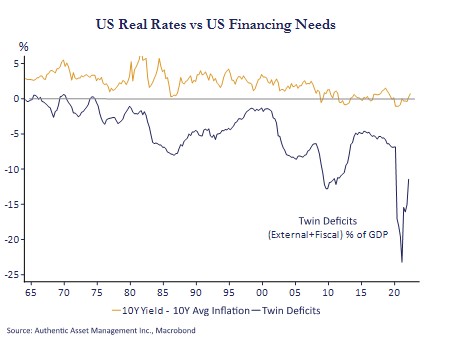

This chart gives us a different way of revisiting the adjustments underway as Fed tapering and QT (Quantitative Tightening) gathers momentum. The chart demonstrates the US needs a whole lot of financing owing to bulging fiscal and external account deficits (Twin Deficits), but the message here is that those financing needs have shrunk massively relative to the height of the Covid pandemic. This demand for financing would have typically forced an adjustment in either yields (higher) or the USD (lower), or some combination of the two. We posed the question more than a year ago that if monetizing of deficits recede will the USD adjust lower, or will real yields adjust higher?

Our view was that odds were good that real yields would assume the brunt of the adjustment and if past was prologue, that adjustment would be swift. It has been. But, along the way economic growth and reduced fiscal spending has also helped shrink the scale of financing needed as evidenced by the sharp improvement noted in the chart. This has offset the impact of the strong USD.

The net effect here is a positive one and anything that diminishes the type of dislocations we saw a year ago supports hope that a soft landing is in play. Moreover, reduced financing needs take some of the sting out of the vacuum of Fed buying left in the wake of QT.

But it also highlights a glaring vulnerability for the USD. Should a more negative economic outcome emerge over coming quarters at a time when inflation is running high then what? In that case, twin deficits would increase (balance of higher government deficits running ahead of any improvement in trade deficits) and with-it external financing needs.

With inflation running high one cannot expect the Fed to reverse QT and re-launch QE. Real yields may move lower, but in this case, the burden would be on the USD to weaken considerably.

#AuthenticAsset #portfoliomanagement #investment