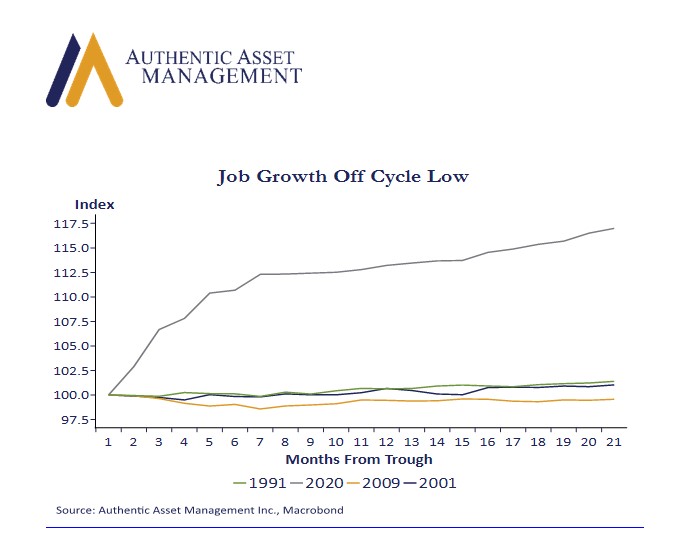

We know the US job market is strong, but the chart here demonstrates just how strong it is and has been relative to past economic cycles. It shows the pace of job gains from the low point in the cycle (indexed to 100). In the current cycle, the 16% or so increase over the first 21 months since April 2020 has not just been swift, it puts all recent recoveries to shame.

As we agonize over what the job gains will be on Friday and as we scrutinize the implications of an expected weaker report one is well served to keep this in mind. To be sure, there is a good argument to be made that the pace of job growth is also a function of the unprecedented shock in early 2020. Job growth collapsed at a speed that also put other cycles to shame. In addition, like past cycles, we continue to operate with a net jobs-deficit relative to the recent peak, even with all this job growth.

Moreover, the more hawkish turn by the Fed has already paid dividends as evidenced by the sharp drop-in long-term inflation expectations. Their inflation fighting credibility is intact. The market suggests policy makers are not behind the inflation curve.

These are all good points. For several reasons, however, we suspect they do little to alleviate the current unease at the heart of the policy pivot last quarter. First, the speed of improvement creates more unease given policy tools that operate with a significant lag to real economic activity. Second, record fiscal and monetary stimulus persist —-this too creates unease as labor market tightening proceeds unchecked.

Third, unlike prior cycles, this labor market stands out in terms of less favorable supply and demand factors. Would be workers are retiring at a faster rate, the labor pool is aging, and the global supply of cheap labor has already been largely absorbed. This is showing up not just in wages, but in quit rates that are at multi decade highs and worker dismissals at multi decade lows.

Finally, it is worth emphasizing inflation is already here. That may be eroding much of the real wage gains from tight labor markets which in principle is disinflationary, but that too creates more unease among policy makers. All things equal, if you now control inflation, you need to deal with another potential burst of inflation through surging real wage growth that in all probability cannot be offset by trend productivity growth.

This is the big picture that has the Fed on edge. A deceleration in job growth in January will not change that, nor will it change the expected path of policy tightening over the current year. Good luck.

#AuthenticAsset#portfoliomanagement#investment

For more Insights by Authentic, please visit: https://authenticasset.com/insights/