Is discretion the better part of valour? Often. But not always when it comes to the financial markets.

Let’s take a quick tour of the development of the US interest rate markets. It sheds light on the stock market outlook.

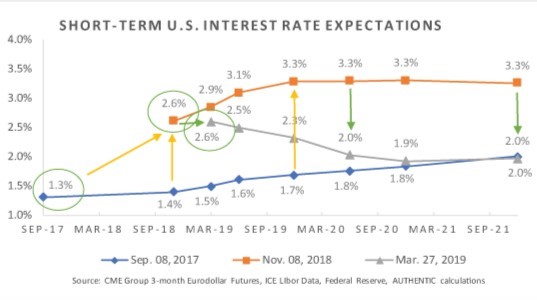

The chart above is surprisingly insightful. It shows interest rate expectations at three points of time, and how they evolved up along the yellow arrows and then down along the green. Consider the following:

Market disbelieves the Fed Blue Line (Sep. 08, 2017)

A year and a half ago, the 3-month US interest rate was at 1.3% (circled blue point at left). From that left point, the blue line shows how the market was expecting the rate to develop in the future. The 3-month rate was expected to rise to just 1.6% by June 2019 and 2.0% by Dec. 2021. In stark contrast, the Fed at the time was projecting the rate to develop a full 1% above that expectation. Based on the year prior, the market didn’t believe the central bank. The Fed was expected to cop out once again from effecting the rate hikes they were verbalizing.

Over the course of the period from Sep. 08, 2017 to Nov. 08, 2018, the S&P500 and Nasdaq rose 13% and 20% respectively.

Market comes to fear Fed Orange Line (Nov. 08, 2018)

Roll forward 14 months. The Fed put its money where its mouth was; they hiked rates by 1%. This drove the 3-month rate to 2.6% (circled orange point). Furthermore, the Fed indicated there was more to come; they revised up their projection of where rates would be in 2020 by ½%. At this point, as the orange line shows, the market was taking the Fed seriously. The market revised upwards its pricing of where rates would be in Dec. 2019 by a further 0.7% to 3.3%. This projection was a sizable 1.6% above their expectation of 14 months earlier.

Stock markets roiled lower once the resolve of the Fed sunk in. In the short period between Nov. 08 and Dec. 24, 2018, the S&P500 and Nasdaq fell -16% and -17%.

Market topples the Fed Grey Line (Mar. 27, 2019)

Under that sudden market pressure, the Fed caved in. They flip-flopped in their Dec. and Mar. meetings, killing rate hike projections for this year, limited it to just one next year, and thereafter, it would be as they say in Looney Tunes, “Bda bda…That’s all folks!”

Fast forward the full 4 ½ months from Nov. 08 to today. The 3-month rate hasn’t budged; still 2.6% (circled grey point). However, the market is now asserting a dramatic new interest rate outlook, pricing 0.3% lower by Dec. and another 0.3-0.4% lower thereafter. That’s a huge swing from the previous expectation of rates 0.7% higher by year end and then steady thereafter.

As the market succeeded in overthrowing the Fed from projecting further rate hikes, the stock market recovered from the slump. From the Christmas eve low to Mar. 27, the S&P and Nasdaq surged 20% and 25% respectively.

AUTHENTIC View — So how are we left?

The market is back to where it was 18 months ago in pricing future short term US interest rates, holding steady at 2% from June 2020 onwards.

Unfortunately, there is a key difference. The current 3-month interest rate is 2.6%. Back then it was 1.3%. To get back to 2% now requires two rate cuts by the Fed in the year ahead. That seems a stretch.

Successfully cajoling the Fed not to hike rates is not the same as bullying them into cutting rates. After all, the current rate is not high. It is only at the lower end of the Fed’s neutral range (with the upper end at least ½% higher).

We do not expect these market expectations to be satisfied. Cutting rates would mean the Fed has crossed a serious invisible line. Either their good stewardship is thrown into question, or a softening economy has forced them to act out of a position of weakness. Neither of these are palatable.

As for the stock market, the level at the bottom on Christmas eve was just around where it was on Sep. 08, 2017 (S&P500 –5%, Nasdaq -1%). Seemed about right. Tighter monetary policy, softening growth, and trade issues, made a wash of the big 2018 US corporate tax handout. With the latest rebound, these stock indices have returned to 15% and 24% above where they were 18 months ago. Liquidity from the swing lower in forward interest rates, and the dearth of investment alternatives that comes along with it, explains part of it. Forward expectations of Chinese fiscal stimulus and trade resolutions are wildcard positives, but the more they succeed in ameliorating the economic slowdown the less likely the Fed is to be bullied.

To consider stock markets at current levels to be on firm footings is a stretch. From here on in, discretion may be the better part of valour.