• If 2022 was about inflation and chasing the peak in policy tightening, then 2023 will be about how low growth will go, if a recession is averted, and if central banks will respond as they have in the past. Forward indicators of inflation suggest inflation risks will recede significantly, but overall inflation will remain well above target and handicap hopes for a significant policy pivot to lower rates.

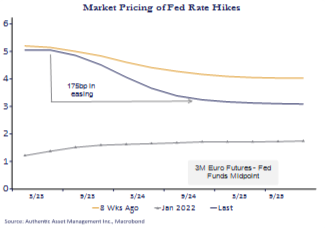

• We expect a shallow recession by mid 2023 as an increasingly likely outcome. Market expectations for 175bps in cumulative easing by the Fed feels optimistic and only achieved by a sharp downturn not currently priced into equities.

• Equity markets will remain volatile as the valuation adjustment notable in 2022 remains incomplete. As earnings estimates get revised lower fair value on the S&P 500 around 3500 or lower will provide better entry points for longer term investors.

Transition Part Deux

The past year was a year of transition. Surging inflation forced central banks the world over to tighten monetary policy aggressively leaving markets to cope with the end of easy money and to grapple with the economic consequences of this new regime. Few markets were spared. Sharp declines in both the equity and fixed income markets tested the viability of the 60/40 investing model, credit spreads widened and even commodities, one market that proved resilient in the aftermath of the Ukraine War, ultimately succumbed as well.

The current year will be characterized by coping with the next stage of this transition as we move beyond peak inflation and the peak in policy rates. Foremost among these is gaining clarity on the economic fallout and whether recession fears are well founded. Thus far, the economy has proved far more resilient to tighter monetary policy than most believed. 2023 is a year of reckoning and we believe a recession will be hard to avoid. What is harder to gauge is the depth of that downturn and whether inflation will have eased enough to provide scope for the proverbial policy pivot, and if so by how much? Market projections for 175bps in easing by the Fed by the end of 2024 feels optimistic, and even if it proves correct, it will imply a negative growth outcome yet to be priced into the markets.

If 2022 was about inflation and guessing the level of peak policy rates, then 2023 will be about concern about how low growth will go and if central banks will respond as they have in the past. This uncertainty means 2023 will start off as another volatile one for global markets, and a challenging one for risk assets.

Economic Backdrop – How Low Can We Go

Economic growth will be lower in 2023. The question is by how much and when it is likely to trough. We suspect the year could be a tale of two halves. If growth troughs mid-year and policy rates are reduced then sentiment will shift setting up the second half to be a stronger one for growth and risk assets. Equally plausible, however, is a scenario in which a shallow recession persists longer than expected as the policy pivot fails to materialize.

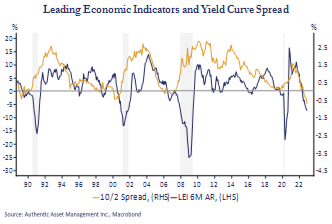

At a high level, the optics are not very encouraging. In the US the index of leading economic indicators has fallen sharply and at a rate that has always led to a recession. That signal is supported by bond markets where the yield curve (2’s10’s) is inverted by the most in decades (Chart 1). Thus far the US and Canadian economies have proved resilient. Part of that stems from what was a large cash surplus from previous Covid support programs, one that cushioned the full impact of policy tightening. However, those cash balances are now close to being depleted. Resilience may also prove illusory as the bulk of policy tightening operates with a significant lag to economic activity. As the full brunt of policy tightening takes shape in 2023, the odds of a US and Canada recession by mid-2023 becomes uncomfortably high.

US growth is likely to recede to something close to 0.0% to 0.5% (compared to 6% and 2% in 2021 and 2022) and a similar outcome looks reasonable for Canada. This would be consistent with a shallow recession by mid-year. However, negative feedback from weakness elsewhere remains a risk. The UK is already in recession, Europe is about to enter one, and the IMF growth forecasts for the world economy continues to be revised lower and at sub 2.0% is consistent with a global recession.

Central Banks – Almost There – Then What?

It is into this backdrop that the world’s major central banks remain extremely hawkish. For the first time in over 40 years both the Fed and the BoC have raised rates above the prior peak of the preceding cycle, and they have done so at a time when both economies are saddled with near record levels of debt. That tightening effect has been amplified by the central bank balance sheet reduction programs. This poses a real risk of overtightening. It is why the market has priced in 175bps of easing beginning mid-2023 (Chart 2).

Whether there is scope for central banks to respond to an economic slowdown will depend critically on both the scale of that slowdown and the path of inflation. On inflation, it is clear policy is winning. We no longer have an inflation emergency. Core prices are high but receding, core goods prices are at back to pre-covid levels, core prices ex shelter are also at pre covid levels, and we know shelter costs are poised to collapse over the coming 18 months owing to the lagged effects of tightening. Supply chains have normalized, shipping costs have collapsed, commodity costs have fallen, and weakness in demand will slow wage growth.

The key question is how long rates stay at peak levels and to what level inflation finds its new equilibrium. If the Fed raises rates another 50bps in Q1 as expected that would add to what is already an enormous pool of tightening that has yet to work its way into economic activity. Should a recession come to pass against this inflation backdrop policy rates could and should be reduced modestly lower. After all, lower inflation has the perverse effect of amplifying the level of rates in real terms. However, the scope for lower rates may be handicapped by inflation that is lower but still stubbornly high. This is a key risk to the markets.

The market expects a series of rate cuts even without a recession. Absent a surprising drop in inflation, this is unlikely. Something has to give because 175bps in easing without a significant downturn in the economy is not a probable outcome. Either way, stubbornly high and increasingly restrictive rates and/or weaker growth means 2023 sets up as a challenging one for equities.

Equities -Valuation Adjustment Incomplete

The valuation adjustment is still incomplete. Over much of 2022 market valuations were driven by multiple compression, a move consistent with a higher inflation rising rates environment. The market, however, is still pricing in a benign economic outcome we view as unlikely. Downward revisions to EPS estimates have begun to materialize as expected, but more downward revisions are in the offing. S&P500 earnings, currently revised down to $231 per share should fall further, toward $215 per share or lower as growth disappoints and margin compression accelerates. That represents a modest 2.3% fall from 2022 earnings. If we assign a multiple of 16x earnings then fair value feels closer to 3500, or approximately 8%-10% below current levels.

These may be optimistic assumptions. In anything but the shallowest of recessions the earnings declines are typically more significant and the multiples on those earnings considerably lower. However, our view on 2023 is based on the presumption that nominal growth (as opposed to real growth on which recessions are determined) and the labor market remain atypically resilient. The bottom in equity markets remains uncertain. However, the direction feels more certain, and we view the risks to these estimates as tilted to the downside.

Fixed Income – Valuation Adjustment More Advanced

Bond markets should not expect a repeat of the rout seen in 2022. First, we are fast approaching the peak in monetary policy tightening and what few rate hikes remain are already priced into the market. Second, inflation premium has already been squeezed out of rates – it is the real rate premium that dominates – and as recession risks loom odds are good that we have seen the high in longer term rates even in the absence of any easing by the Fed. The copper/gold ratio is already suggesting longer term rates may have gone too far too fast. However, unfavorable supply and demand factors will act as a brake on the scope for any significant move lower. Funding needs are rising, and the Fed’s balance sheet continues to shed duration. Moreover, the recent move by the BoJ to widen the rate band could encourage Japanese investors to sell some of their unhedged global bond portfolios dominated by holdings of Treasuries.