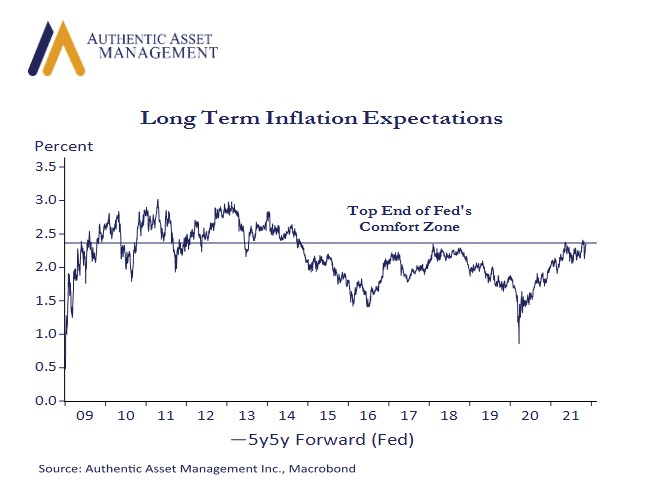

Market expectations for Fed rate hikes in mid-2022 look misplaced unless this chart begins to change to the upside. Despite 5y breakeven inflation at record highs and constant chatter on underlying inflation risks by analysts and in the media (which we are sympathetic to), the underlying reality is that long term inflation expectations that have the Fed’s attention are well anchored.

The Fed will act if those expectations become unanchored. That is when inflation psychology begins to create a negative feedback loop of higher prices. But as of now, 5y5y forward inflation expectations, a measure of whether current inflation risks are viewed as persistent, are at the bottom end of the Fed’s comfort zone. This we define as within a range of 2.2% to 2.5%, or a rate of inflation consistent with hitting their long term 2.0% target on core PCE prices.

This is critical to understanding the ebb and flow of how the Fed benchmarks risks around their policy narrative. That narrative remains one leery of reining in demand to reduce the clearing price of output in the economy. Supply constraints are a key factor limiting economic growth next year and the key factor pushing prices today. Fed’s policy is premised on a hope that supply driven constraints fueling much of the recent price gains will ease and with it the potential for a more negative outcome on inflation. The market continues to share that view.

A sensible challenge to this policy is that stable prices are needed to create a healthy economy and achieve the Fed’s broader employment objectives and 30-year highs on the CPI “aint” it. Powell and others will argue, however, that prices are stable. They will say “look at this chart.” They might also offer that chip shortages plaguing the auto sector are already beginning to clear as are supply constraints in the oil sector. This does not mean the Fed cannot accelerate the tapering timeline. After all, if tapering is done by June 2022 the Fed is still set to add another $400 to $450 billion in liquidity to the system between now and then and this is clearly not what the economy needs. It will, however, be a key factor in how aggressive the Fed will feel it has to be in raising rates.

This is a risky policy proposition of course. The market may be wrong. The Fed may be wrong. However, current policy narrative will not change unless longer term inflation expectations force the Fed’s hand. That is when they risk undermining their hard-won inflation fighting credentials and no central bank, not even the Powell or Brainard Fed, can afford to have that happen.

#AuthenticAsset#fedpolicy#inflation#portfoliomanagement

For more Insights by Authentic, please visit: https://authenticasset.com/insights/