The Fed raised rates yesterday as expected. It was the first time the Fed began a tightening cycle when volatility was this high, at a time when equities had corrected this much, and when the yield curve was so flat, at least in data going back 40 years. That is not the only first. It is also the first time in data going back to the mid 1970’s that the Fed began tightening from such a period of extreme accommodation. Within this is a clue that the Fed is behind the curve. It explains the more hawkish tilt by policy maker’s expectations on how high rates need to move and suggests that only some unforeseen exogenous shock can knock their newfound steely determination off track.

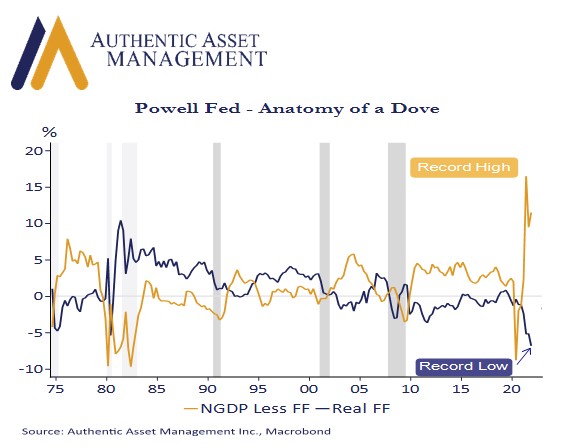

The chart shows these extremes in historical context. Nominal GDP (NFDP) less the policy rate gives a view of how much monetary juice the Fed provides for each unit of output generated in the economy. That measure tends to surge out of recessions as rate cuts produce the desired rebound in growth and the beginning of the new cycle which the Fed ultimately fine tunes as the expansion matures, inflation rises, and the Fed begins to raise rates. The chart shows just how far the Fed has let this post covid economy run in the teeth of rising inflation. It is not just very high, it is at a record high, and at a time when nominal output (in level terms) is already above its long-term trend. Toss in an expected growth rate of 9% in NGDP in 2022 and the gap between where the Fed wants to be and where they will be is likely to remain around record highs even as rates rise. Similarly, real policy rates that are at record lows are likely to turn more accommodative over coming months given the scope for rising inflation to outpace the tightening from higher rates.

The Fed policy rate is not the only factor that shapes financial conditions which at any given moment are affected by the performance of real assets such as equities, credit spreads, volatility, and the shape of the yield curve among others. However, it is the predominant one. How these factors interact to tighten financial conditions further may differ over time and across economic cycles each of which operates under its own intrinsic momentum. It is why policy making is an art and not a science. It is also why nobody can be certain how far the Fed will have to go in 2023 and beyond to achieve the type of equilibrium so sorely missing today.

Charts such as these as well as Taylor Rules and other metrics of policy accommodation explain the policy pivot last quarter and shape our expectations for future rate hikes and the challenge facing the Fed. We know the lift is significant and the task to do so without creating a recession a perilous one. We wish them luck.

#AuthenticAsset#portfoliomanagement#investment

For more Insights by Authentic, please visit: https://authenticasset.com/insights/