The economic growth outlook for 2022 will be slower than expected several months ago, but slow growth is not the same as no growth. Estimates for growth in the US have been trimmed by about 0.5% in 2022 to 3.0%, by about the same margin in Canada to approximately 3.5%, and globally by 0.7% to 4.2% which is down from the 5.9% pace last year. These are still solid growth projections. Odds are rising, however, that they may be too rosy. The good news is that household balance sheets remain strong, as does labor market demand, and this provides some scope to absorb the erosion of purchasing power from higher inflation. Nevertheless, there are signs that tighter financial conditions will soon manifest in slowing demand, and with global trade slowing and government spending also weaker the balance of factors supporting growth are slipping.

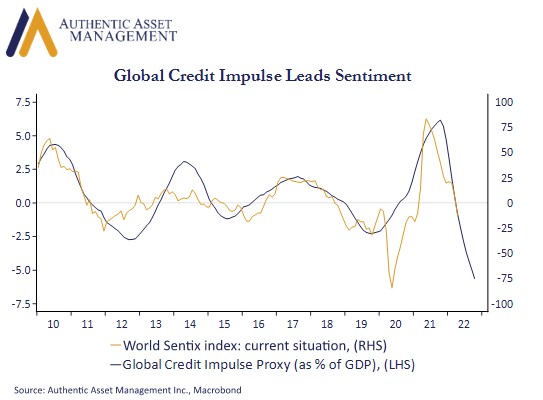

The chart here shows the flow of global credit as a percent of GDP and that ratio is slipping. It suggests global economic sentiment will deteriorate and could reinforce what is setting in to be a deceleration in growth. A similar sentiment is seen in a yield curve flirting with inversion, something that in the past always signaled an impending recession though with varying lags. A recession will come, eventually, but we do not expect it to take shape in 2022. Europe looks the most vulnerable to recession as energy costs take a disproportionately higher bite out of growth prospects.

On balance, however, while global growth prospects have dimmed, they have not been derailed, and in this there is room for optimism.

#AuthenticAsset#portfoliomanagement#investment

For more Insights by Authentic, please visit: https://authenticasset.com/insights/