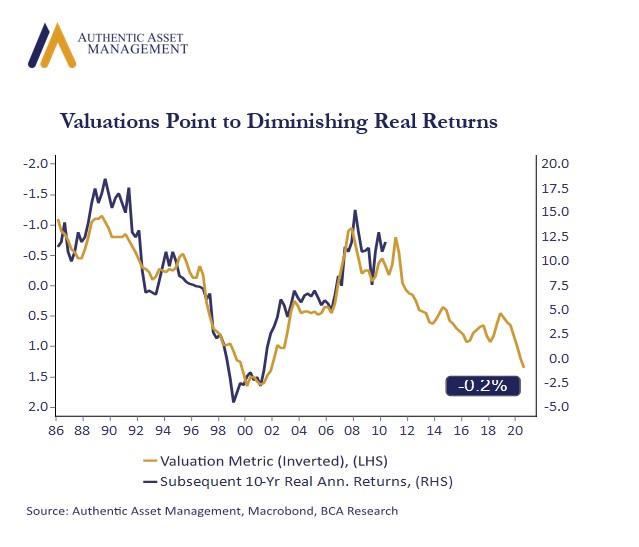

This chart foreshadows how real returns in equities are likely to evolve over coming years based purely on a host of standardized valuation metrics plotted against real equity returns over subsequent years. Equity valuations are high, we know that, but the chart nicely illustrates what that may mean for future returns based on previous periods of high and low valuations. If past is prologue, then the current elevated premium investors pay for earning streams is essentially pulling forward returns otherwise enjoyed later. With a lag of 10 years the path of likely real returns is now poised to steadily decline converging toward zero. It means the low hanging fruit has been plucked. The need to diversify one’s returns is what will grow.

Of course, nothing is a certainty and real returns will be based on many different factors including earnings growth, inflation, and interest rates among others. At this point we know earnings growth is robust, operating margins are wide, and the pandemic has created a mini (positive) productivity shock, one that brought forward much of the digital innovation previously expected to materialize 5 to 10 years down the road. The challenge will be to build upon the recent strong productivity momentum, but on this the historical record of recent years is not terribly encouraging. Even if we presume the productivity gains will persist over time, growth is likely to be handicapped by aging demographics (weak labor force growth), high debt loads in the public and private sector, and interest rates that are likely to be moving higher, not lower.

Odds are therefore low for any significant upside surprise to earnings growth. If so, that only reinforces the basic message that frothy valuations today have pulled forward real returns that are otherwise poised to diminish over coming years. Perhaps the premium investors pay per unit of earnings growth will save the day? Perhaps, but not likely. De globalization of supply chains and labor scarcity suggest the inflation regime has shifted approximately 50bps higher. Large fiscal deficits, large external deficits, and higher inflation together mean interest rates are likely to move higher. Higher inflation and higher interest rates mean investors will not pay more per unit of profit growth. They will pay less.

This scenario puts a premium on diversification in one’s portfolio. However, the traditional 60/40 equity bond allocation is likely to struggle. Real returns that are already deeply negative in much of the bond universe (including High Yield Junk) is not much of a lifeline for diminished returns on equities. Investors will be better served to explore absolute return strategies that offer low correlation to equity markets, and ones without the risk for capital loss presented by most low yielding fixed income assets.

#markets #economy #investing #equities #portfoliomanagement

For more Insights by Authentic, please visit: https://authenticasset.com/insights/