A common misconception is that a sustained rise in core inflation over time depends on wage inflation, but that is only part of the story. The true driver of trend core inflation is unit labor costs, and for those old enough as me will remember it was former Fed Chairman Alan Greenspan’s favorite measure of labor costs. Why? Because it measures the cost of labor in the context of how efficiently one produces stuff. You can pay more for labor, but if you produce more per unit of labor then the result is not inflationary. So, core inflation depends not only on compensation costs, but they also depend critically upon productivity.

It is too soon to determine if the recent jump in productivity or increase in wage pressures will be sustained, but what we do know is that unit labor costs are rolling over (like most everything else) and the extent to which these labor costs drive inflation will take some time to determine. It is why the Fed is prone to focus on inflation as more transitory than not. Even if we believe trend inflation has increased by approximately 50bps, which we do, it is hard to prove the Fed wrong because there is little to suggest otherwise, at least not yet.

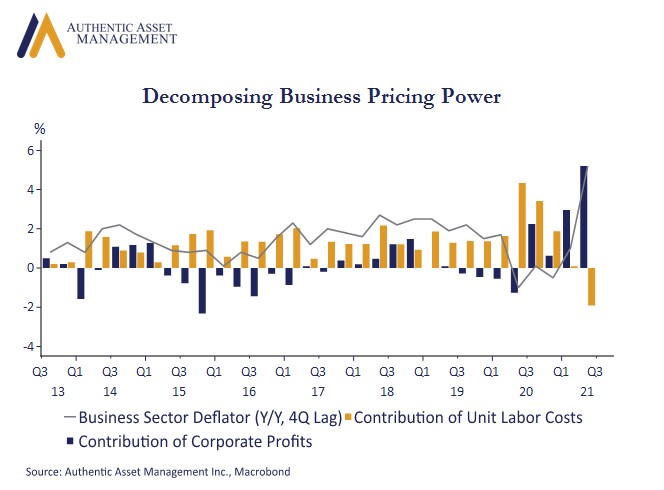

We can look at this in a way few consider by using the Business Price Deflator. This is effectively a measure of business pricing power and is composed of several interrelated components that include unit labor costs per value added, unit profit growth per value added, and unit non-labor costs as a percent of unit value added. You can see in the accompanying chart that business pricing power has been and remains strong. The price deflator has spiked higher (faint gray line) owing not to the contribution of unit labor costs (that has decreased), but to a spike in unit profit growth (the blue bar).

I apologize for the difficult chart, but it is worth emphasizing that there is nothing of concern here for the Fed or anything to suggest stagflation is afoot. In effect, prices have been rising on strong growth (not weak growth) and strong profit growth. The Fed would be concerned if a strong trend of rising gold bars (unit labor costs) were to develop because it would suggest margins are getting squeezed and firms would be forced to raise prices. That is the self-reinforcing feedback loop that can push trend inflation above price stability. That may take shape in the fullness of time, but at this point business pricing power viewed in this light indicates it hasn’t.

#economy #markets #investment #portfoliomanagement #fed

For more Insights by Authentic, please visit: https://authenticasset.com/insights/