Recent forecasts by the Fed’s staff in Washington has received much press of late in their expectations for inflation to decelerate back towards 2% in 2022. That feels like a heroic statement, almost foolish. However, it is not and as a former Fed economist, I have utmost respect for their forecasting ability. The key point, however, is not the core inflation will decelerate, it will and why it does so is embarrassingly straightforward. The key point is that optics may be deceiving. The pandemic distorted prices on the way up and will distort them on the way down. The big question is what happens after that, and a deceleration toward 2% does little to settle that issue.

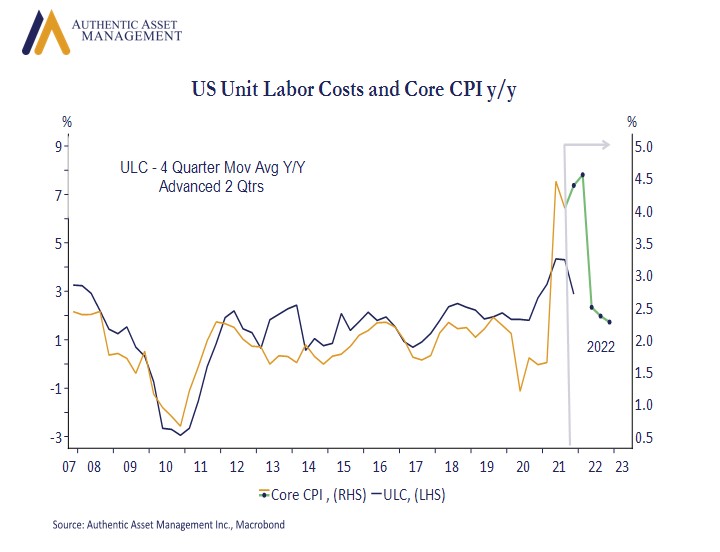

The chart shows core inflation plotted against unit labor costs which measure the true cost of labor (adjusted for productivity). The forecast line is not an official forecast from Authentic (though it could be). Rather, it is a tool to show how the path of inflation will evolve owing to base effects and the assumption that supply chain disruptions will ease, not worsen. If we just assume that the average monthly gain in Q3 core inflation (at around 0.2%m/m) is a reasonable expectation, then core inflation will rise further before it falls sharply over 2022. That assumption is a reasonable one. Import prices over the next year will dampen inflation and the monthly gains inserted here are above the recent 10-year average of 0.16% m/m.

In effect it will feel like we are getting back to price stability even if we plug in a monthly trajectory for inflation higher than the post 2008 average. So, the 2022 profile needs to be taken with a grain of salt. That applies as much to the peak in Q2 at around 4.5% y/y as it does to its retreat toward 2.1% by year end 2022.

So why should one care? Getting the inflation story right is the single most important objective to position your portfolio accordingly and you can only get it right if you are aware of the noise and keep your eye on the underlying factors that WILL shape the post pandemic path of inflation. High inflation is toxic for fixed income, toxic for 60/40 portfolio investing, toxic for those betting on ever higher equity multiples, and toxic for passive investing practices that risk being introduced to something more nefarious.

Nobody knows if inflation has shifted structurally higher, at least not yet. It may be why 5y/5y forward inflation expectations have settled in an area that feels safe, at around 2.3%, or a smidgen above its long-term average of 2.2%. Whether our suspicion that the reduction in the supply of cheap global labor, re-shoring of supply chains, higher input costs, and an emerging structural mismatch in the labor market outweighs impact from productivity and rising automation is the correct one takes time. In the meantime, don’t be fooled by the Fed’s sensible inflation forecast that itself does little to settle this question.

#investing #inflation #portfoliomanagement

For more Insights by Authentic, please visit: https://authenticasset.com/insights/