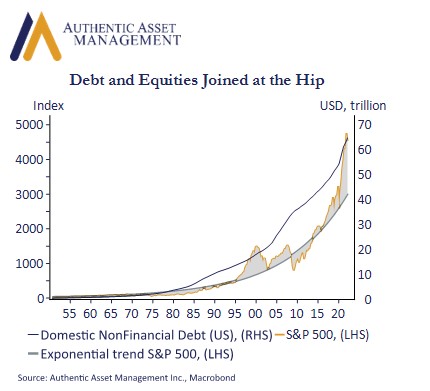

A longer-term view of equity prices over the past several decades shows a breathtaking rise in market values. Over this period, it has felt like the best of all possible worlds. Globalization, the broadening out of a cheap pool of global labor, low inflation, low interest rates and for some time anyway a tidy peace dividend from the end of the Cold War. Debt was accumulated at a record rate, shown in the chart as the Fed’s flow of funds data for domestic nonfinancial sectors. That includes you, me, and government among others. Debt has surged and with it the value of the S&P 500 in absolute terms and relative to its long-term trend which is otherwise also moving sharply higher.

Since the triumph over inflation in the early 1980’s these good times were reflected in two distinct paradigms, one pre 2008 financial crisis, one post. Both were characterized by a debt binge that pushed growth higher and with-it equity markets. What may be less well known is that this symbiotic relationship had deteriorated by the early 2000’s with each unit of debt squeezing out a smaller and smaller unit of growth.

A fresh debt financed growth engine arrived on cue in 2008 – the world of easy money and quantitative easing. Real interest rates plunged to new lows, liquidity was ample, and it felt almost financially irresponsible not to borrow. That greased the tracks for growth above what it otherwise would have been and along with it equity markets, supported by multiple expansion and strong profits. The beat went on.

It all worked provided inflation remained tame so central banks could accommodate this perpetual upward sloping debt engine. Now things have changed.

The prevailing wisdom is that this accumulated debt will prove disinflationary to the broader economy. There is some elegance to this logic, and it is supported empirically by a coincident 40-year period of disinflation from which we are emerging. Debt will continue to be accumulated, but that pace will likely establish a new baseline relative to its 40-year trajectory.

The Fed will hope this proves disinflationary, but at what cost? At what cost to growth, jobs, and corporate earnings as the rising cost of money diminishes the incentive to accumulate more debt to finance consumption and investment at a pace akin to recent decades. These realities are converging at a time when de-globalization, aging demographics, and tepid productivity growth become more of a secular tailwind to inflation and less and less supportive to economic prosperity.

The chart illustrates a trajectory of debt and equity markets emblematic of an old paradigm now in transition to something else. I don’t know what that new paradigm will look like. My instincts tell me it will be different, and not as joyous to equity investors as the last one.

#AuthenticAsset#portfoliomanagement#investment

For more Insights by Authentic, please visit: https://authenticasset.com/insights/