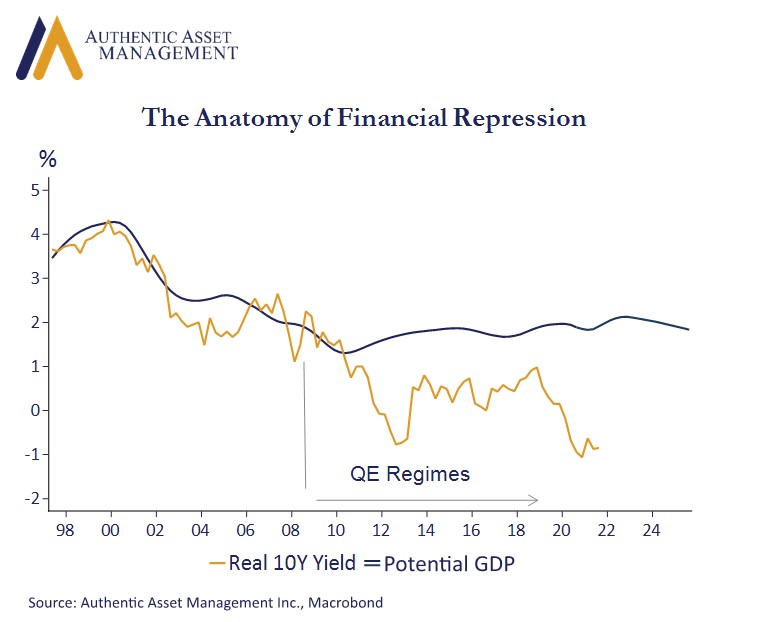

Real interest rates are too low and if you believe this then you believe equity multiples are too high. On the eve of an accelerated taper by the Fed, it makes sense to take a deeper dive into recent history to see just how low rates really are relative to where they should be. We can see this tension in the chart. It tracks the path of real US 10-year yields against real potential GDP. What stands out is the significant disconnect that set in at the onset of the QE era beginning in the Financial Crisis of 2008.

There are many times when real growth fails to meet potential and low real rates may be reflecting a persistence of an undershoot. For much of the time since 2009 real growth has steadily been lagging potential output, so in principle there is some elegance to this view. However, we do not subscribe to it. To be sure, there are long term headwinds to growth that we have touched upon repeatedly in these posts. However, the elements supporting growth over the next few years look robust.

Judging from the Atlanta Fed GDP now estimates Q4 2021 is going to be a whopper at around 9%. Real GDP will finally be above the potential GDP trend line for only the second time since 2009. Forecasts for 2022 have real output exceeding potential by the greatest margin in decades and yet here we are with real yields at record lows.

It is a graphic representation of the power of financial repression. A key element of this QE bond buying policy has been to manipulate the price of risk. In monetizing deficit spending the market clearing price for interest rates has remained too low. It has had the intended effect to push risk taking into equities on the expectation it will facilitate higher growth. It has worked. However, rising inflation risks have now put a monkey in the wrench. With unit labor costs surging at the fastest pace in 34 years magnifying the risks of persistent goods inflation even before the service price genie rears its head the risk/reward metric for QE has changed significantly. QE is coming to an end. The market clearing price for risk is about to enjoy a burst of freedom.

Nobody has perfect foresight, but one can see where the risks are. That is not just a function of growth and rate hikes. It is also a function of supply and demand and judging by the explosion in US deficits projected by the CBO later this decade the clearing price for debt is bound to move considerably higher.

The adjustment in real rates will not approach anything near real growth rates because we cannot afford to service debt at anything approaching historic norms. Nevertheless, higher inflation premiums and higher real rate premiums are not a good recipe for owning fixed income. It is also not helpful for equity multiples even if earnings growth is robust. These are stark realities, at least until the next round of QE, which is only a matter of time.

#AuthenticAsset#portfoliomanagement

For more Insights by Authentic, please visit: https://authenticasset.com/insights/